Insightology Observation Weekly

06/08/2025

Recent

Last week I returned to Taiwan from Bali and was chatting with friends about launching my own analysis column. This will help me expand my network beyond Taiwan. In just over a month I’ll be moving to the U.S., where it’s not as easy to meet people as back home. So I’ve decided to start sharing some of my professional insights online in English every week—tracking industries and individual stocks. Please note these posts are for informational purposes only and do not constitute investment advice.

About me: I’m an independent industry analyst. In the past, I’ve provided research reports and asset management advice to family offices and investment firms. My focus areas include the semiconductor sector (equipment, consumables, IC design, packaging/testing), the AI industry (software, components), the energy sector, and other niche or interesting industries. If you’d like tailored asset planning suggestions, feel free to email me.

I welcome your emails and look forward to our discussions!

Short-Term Downturn Ahead for Semiconductors, but Long-Term Demand Remains Bright

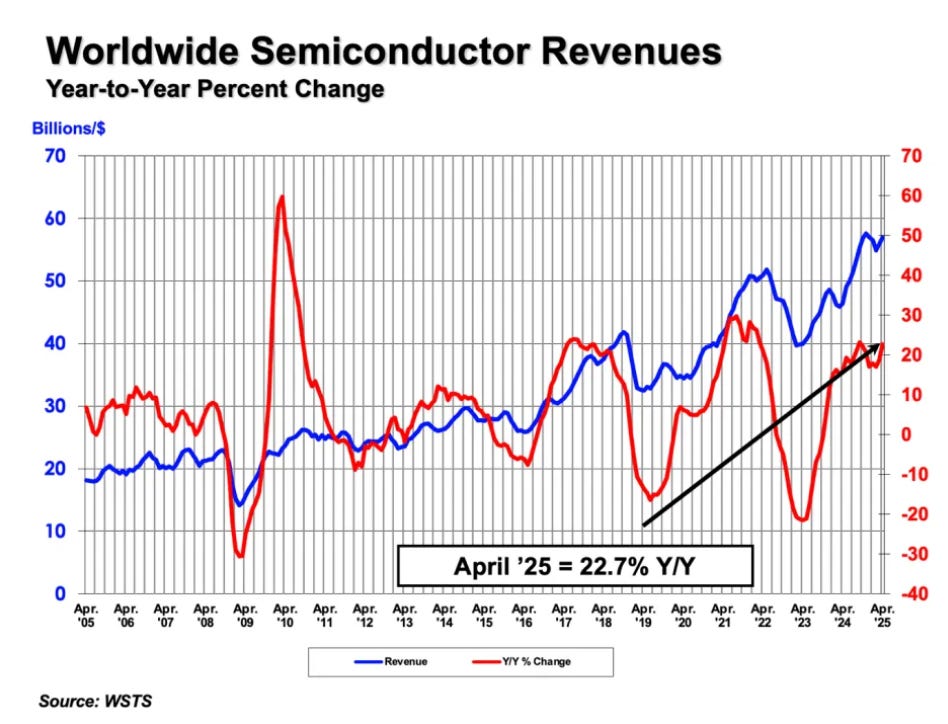

SIA reported global chip sales of USD 57 billion in April, up 1.8% month-on-month and up year-on-year. On a regional basis, the Americas have seen four consecutive months above +40% YoY, though growth has eased from January’s +50% peak.

Looking at past semiconductor cycles:

2020–2021 Memory Supercycle: U.S. YoY growth climbed from 2020 Q4 and stayed above +40% from Q1 to Q3 2021—about 9 months—before a clear pullback in Q4 2021.

2017–2018 Capacity Expansion Phase: YoY growth rose into the +35–45% range from Q2 2017 and oscillated at those highs for approximately 6 months before weakening from Q1 2018 due to inventory adjustments.

Insightology’s View: The semiconductor industry is entering a near-term consolidation at lofty levels. If a downturn occurs, it should be viewed optimistically, with focus on upcoming trends in Modal AI, AI Agents, and Physical AI:

Given the current high plateau (four consecutive months) and market momentum, historical cycles suggest the Americas’ YoY growth could stay elevated for another two months (May and June). By July, last year’s high base could lead to the first dip below 40%.

Historically, a pullback from peak levels impacts semiconductor index valuations—a critical warning signal for investors.

However, from a longer-cycle perspective, there’s no sign of AI inventory overhang. This correction is likely to be more resilient. Current AI models still have plenty of room for advancement, driving Scaling Law effects and continued compute demand—and pushing absolute semiconductor spending to new highs.

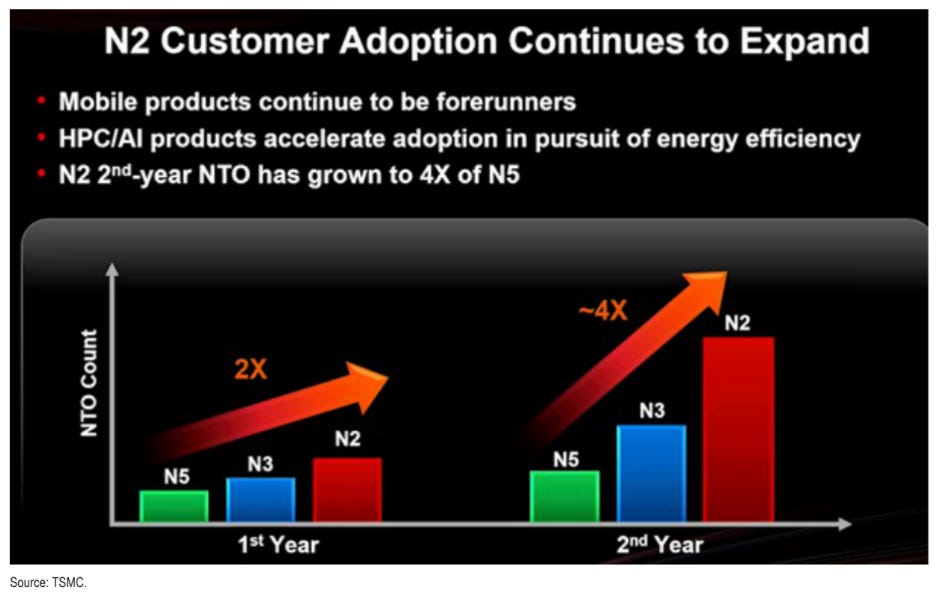

TSMC’s 2nm Process On Track for 25Q4–26H1 Ramp, Big Growth Ahead for Consumables Suppliers and Fab Services

Risk Production Started: TSMC kicked off risk production of its N2 (2nm) node in July 2024. Volume production is slated to begin in H2 2025, especially in Q4 of that year.

Optimized N2P & High-Performance N2X Roadmap: The enhanced N2P variant is expected to enter mass production in 2026, delivering significant gains in both performance and power efficiency. Meanwhile, the high-performance N2X version is on track for H2 2026 production, with the iPhone 17 series likely to be among the first devices to adopt it.