Key Takeaways from TSMC’s (2330) Latest Earnings Call

1. U.S. Expansion Is Now a Structural Trend

Investment size: TSMC plans to invest US $165 billion in the United States over the next few years.

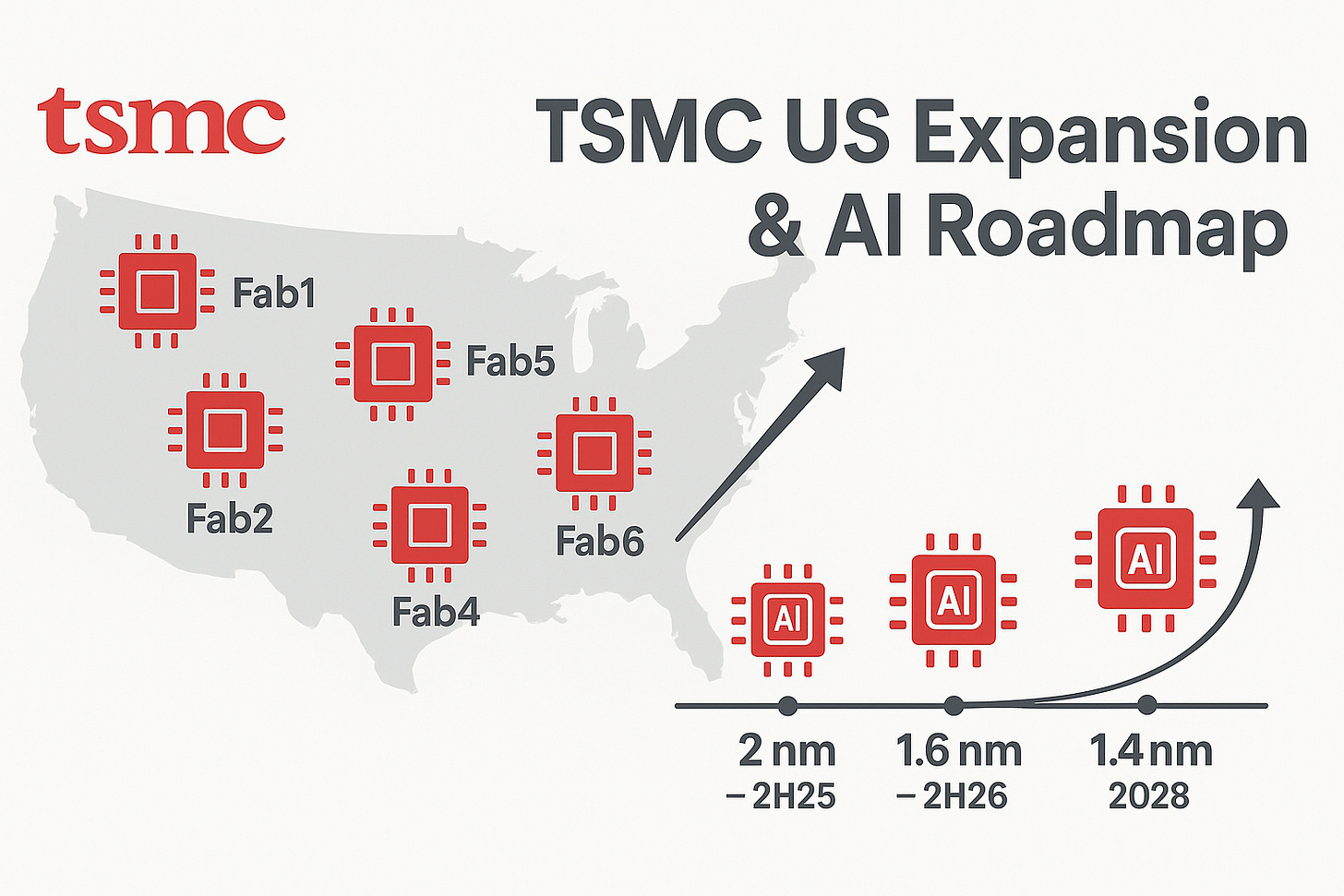

Six fabs in the pipeline:

Fab 1 (4 nm) – pilot production started in Q4 2024; yields already similar to Taiwan.

Fab 2 – construction finished; ramp-up schedule being accelerated.

Fab 3 – under construction for advanced nodes (2 nm / “A16” and below).

Fab 4 – will also run sub-2 nm processes.

5-6. Fab 5 & 6 – earmarked for even more advanced technologies.

Supporting plants: Two advanced packaging plants and one R&D center will also be built.

Opportunity for Taiwanese suppliers: Building a fab in the U.S. costs 3-5 × what it does in Taiwan. If profit margins stay comparable, Taiwan-based equipment and materials vendors could see a major earnings boost over the next few years.

2. AI Demand Is the Main Driver for the Next 2-3 Years

In previous cycles, new nodes ramped up on smartphone demand.

This time, AI and high-performance computing (HPC) are in the driver’s seat.

Because these chips have a much higher ASP (average selling price), revenue from each new node should ramp faster than it did at 3 nm.

3. What This Means in Plain Language

Big, long-term bet on America: TSMC isn’t just building one U.S. fab—it’s laying down an ecosystem that mirrors Taiwan’s, with packaging and R&D on-site.

Taiwanese partners win too: Higher build-out costs in the U.S. translate to larger purchase orders for familiar suppliers of tools, chemicals, and engineering services.

AI is the new smartphone: The insatiable need for AI compute is pulling cutting-edge nodes forward faster than ever.

Relentless road-mapping: Every two to three years, TSMC still expects to deliver meaningful speed, power, and density gains—even as it pushes toward the one-nanometer era.