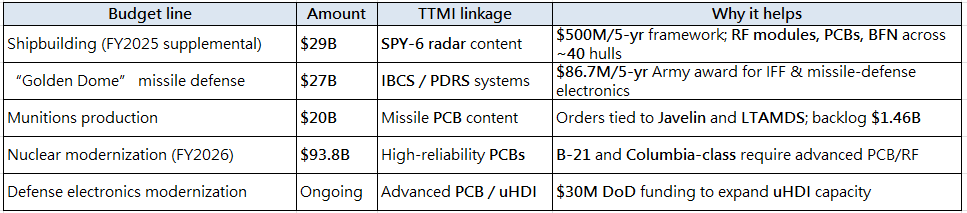

The 2025 fiscal year U.S. reconciliation bill adds $150 billion in new defense spending, with shipbuilding and missile defense budgets reaching historic highs.

Why it matters

TTMI derives ~50% of revenue from Aerospace & Defense, much of it tied to radar systems.

Rising budgets for missile and space programs → stronger radar demand, directly benefiting TTMI.

By the numbers / Detail

Backlog: $1.46–$1.55B at Q1-end, ~1.5 years of revenue visibility.

Award momentum: additional wins across Javelin and LTAMDS.

Platforms in scope (examples):

F-35, shipborne SPY-6 / SPY-7 radars

MH-60 rotorcraft radar

LTAMDS for the PAC-3 ecosystem

Capacity build-out: New facility in Syracuse, NY, purpose-built for Ultra-HDI PCBs targeting mil-grade applications.

The big picture / Between the lines

Shipbuilding upcycle: 14 new ships funded in FY2025—a record. Destroyers, frigates, and carriers all require SPY-6.

TTMI is positioned as the sole BFN and key PCB supplier for SPY-6.

Missile defense surge: “Golden Dome” at $27B plus ~$25B across broader missile defense accelerate IBCS and LTAMDS deployments.

TTMI supplies core electronics into these systems.

TTMI exposure to U.S. defense budget (snapshot)

What’s next

Convert backlog to revenue + ramp Syracuse: uHDI adds capacity against long-cycle shipbuilding and missile-defense programs.

Radar tailwinds: SPY-6 / LTAMDS scale-up sustains multi-year visibility; TTMI’s critical sub-system role amplifies operating leverage.

—

Note: Information compiled from your brief; this is not investment advice.