UMC : A Value Turnaround Play

US-led Semiconductor Collaboration:A New Era of Making America Manufacturing Great

Conclusion and Thesis

Starting from 2026, UMC is expected to gradually move away from the highly competitive environment of low-cost mature processes and shift toward high-value mature processes and specialty technologies. This strategic shift, particularly benefiting from its expansion into US manufacturing, is advantageous for raising the company’s Price-to-Earnings (PE) ratio.

The Macro View: TSMC Holds the Line, UMC Steps Up:With TSMC (2330.TW) signaling clearly that it has no interest in acquiring an equity stake in Intel, the spotlight has unexpectedly shifted to UMC (2303.TW). The company is seizing this vacuum to execute a crucial strategic pivot, positioning itself as a stabilizer in the global supply chain.

The Core Catalyst: The Intel & Polar Alliance:UMC is moving away from the “build-at-all-costs” model toward smart collaboration.

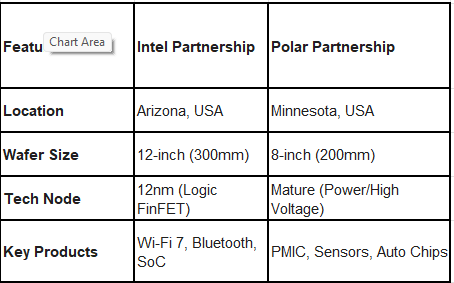

The Intel Partnership: UMC will co-develop a 12nm platform with Intel.

The Deal Structure: This is a classic “Asset-Light” play. Intel provides the manufacturing capacity (fabs) and capital expenditure, while UMC leverages its IP and extensive client rolodex to fill that capacity.

Why it Matters: UMC gains 12nm capacity without the heavy depreciation burden of building a new fab, while Intel solves its utilization issues.

The Polar Semiconductor Deal: Simultaneously, UMC is partnering with Polar to supply high-voltage (HV) power components, specifically targeting Tier-1 US automotive giants.

The “Hidden Gem”: Silicon Photonics (SiPh):Beyond the headline deals, UMC is aggressively planting flags in next-gen connectivity.

Strategic Partner: Collaborating with IMEC (Belgium), the world’s leading semiconductor R&D hub.

The Tech: Entering the Silicon Photonics (SiPh) front-end wafer foundry market using mature 28/22nm processes.

The Timeline:

2026: Pilot Production.

2027: Volume Ramp-up.

Significance: As data centers demand higher bandwidth, SiPh is the next bottleneck solver. UMC is positioning itself early in the supply chain using cost-effective mature nodes.

The Risk Factor

Intel’s Execution: The primary overhang is execution risk on Intel’s part. If Intel struggles with yield rates or mass production timelines for the 12nm platform, UMC’s capacity expansion plans could face delays.

The Analyst Take: A Long-Term Re-rating

This is not an Nvidia-style momentum trade. Do not expect UMC to replicate the parabolic moves of AI component suppliers.

The Narrative: UMC is transforming from a commodity foundry trapped in price wars to a strategic partner with specialized, high-margin offerings.

The Playbook: This is a value turnaround play. We are looking for a gradual re-rating of the stock as it decouples from the brutal price competition of standard mature nodes.

Verdict: Patience is required. Accumulate for the long haul as the “asset-light” strategy begins to improve return on equity (ROE) and margins.

Company Overview and Core Business Transformation

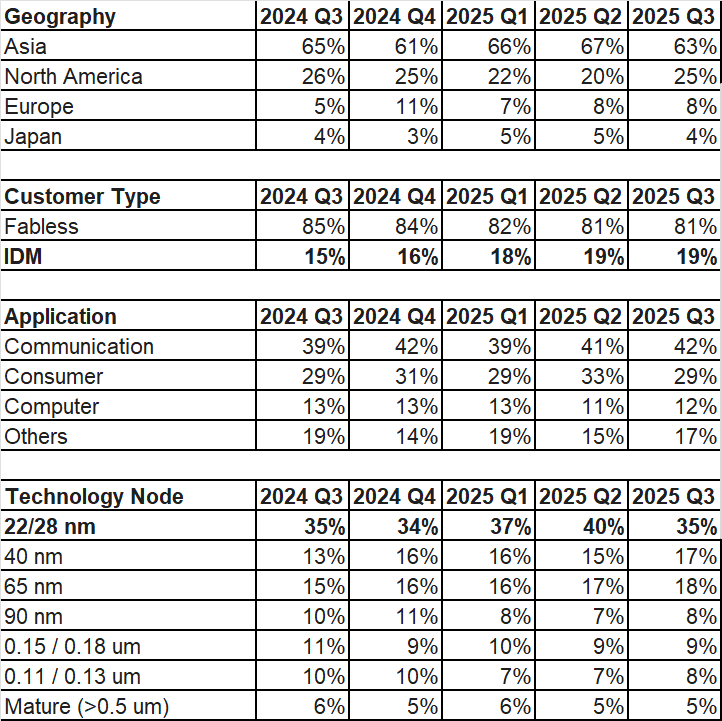

UMC, established in 1980, is currently the world’s fourth-largest wafer foundry manufacturer. UMC’s strategy differs from TSMC; it supports several semiconductor chip design companies (such as Novatek, Faraday Technology, PixArt Imaging, and Holtek Semiconductor) through its own capacity and technology to ensure its foundry capacity utilization rate is maintained. Major customers include international companies such as MediaTek, Qualcomm, Samsung, NXP, and Texas Instruments.

Source : Company

Thesis

I. The Core Business: “Boring is the New Stable”

The Short-Term Reality Check Let’s be blunt: if you are looking for explosive quarterly growth right now, look elsewhere. The core business is currently about stabilization, not acceleration. “Flat” is the new “Up.”

Utilization Rate (UTR) Recovery: We saw UTR climb back to 78% in Q3 2025. We project a slight moderation to 74%–76% in Q4 due to year-end seasonality.

Pricing Power (ASP): Despite headwinds, U.S. dollar-denominated ASP (Average Selling Price) is holding steady for Q4 2025.

The China Factor (The Elephant in the Room): The competitive landscape remains brutal. Chinese foundries (SMIC, Hua Hong) have aggressively expanded capacity across 28nm–90nm.

The Threat: In 2025, the bulk of global mature capacity growth is coming from China. Their quotes are often 30–40% lower than Taiwanese peers.

The Impact: We anticipate a general 5–10% pricing erosion across the mature node market in 2025.

The Strategic Shift: From Volume to Value UMC is smart enough not to fight a price war they can’t win. They are actively pivoting the revenue mix:

Old UMC: Low-end, commoditized legacy nodes (highly sensitive to Chinese price dumping).

New UMC: High-Value Legacy + Specialty Processes.

Focus Areas: 22/28nm, Automotive, PMIC (Power Management), High-Voltage BCD, eNVM, and RFSOI.

Why it works: These are “sticky” products with higher technical barriers. Clients here care more about reliability and performance than saving a few cents on the wafer.

Growth Spots: Management expects double-digit growth in 22/28nm revenue and high-single-digit growth in 8-inch PMIC.

II. The Alpha Play: The “Asset-Light” American Expansion

The Headline: While TSMC politely declined to acquire equity in Intel, UMC stepped up to fill the vacuum—not with cash, but with competence.

The Strategy: “Fabless” Foundry Expansion UMC is expanding its US footprint without the heavy anchor of capital expenditure (Capex). This is Asset-Light Expansion 101: Don’t build the factory; just run it.

1. The Intel Alliance (Arizona)

The Deal: Utilizing Intel’s depreciated Fab 12, 22, and 32 to develop a 12nm FinFET platform.

The Logic: Intel provides the facility; UMC brings the clients (Realtek, MediaTek, Broadcom).

Launch: Production scheduled for 2027.

Synergy: Intel fills empty fabs; UMC gets 12nm capacity without spending billions on concrete and steel.

2. The Polar Semiconductor Partnership (Minnesota)

The Context: Polar, originally a Control Data factory and later owned by Japan’s Sanken Electric, recently brought in US Private Equity (Niobrara & Prysm Capital) to qualify for the CHIPS Act.

The Problem: Polar has the funding and the “US Entity” status, but lacks broad technical depth.

The Solution: UMC injects its 8-inch manufacturing expertise and client base.

The Niches: Focusing on High-Voltage Power and Sensors (Automotive). Clients include Allegro MicroSystems and Sanken Electric.

Why This is a “Triple-Win”

UMC: Gains “Made in USA” capacity at zero construction cost.

Intel / Polar: Monetizes idle assets and gains access to the lucrative “mid-range” mobile/comm market (MediaTek, Qualcomm, etc.).

Clients: Secures a non-China supply chain for mature nodes, hedging geopolitical risk.

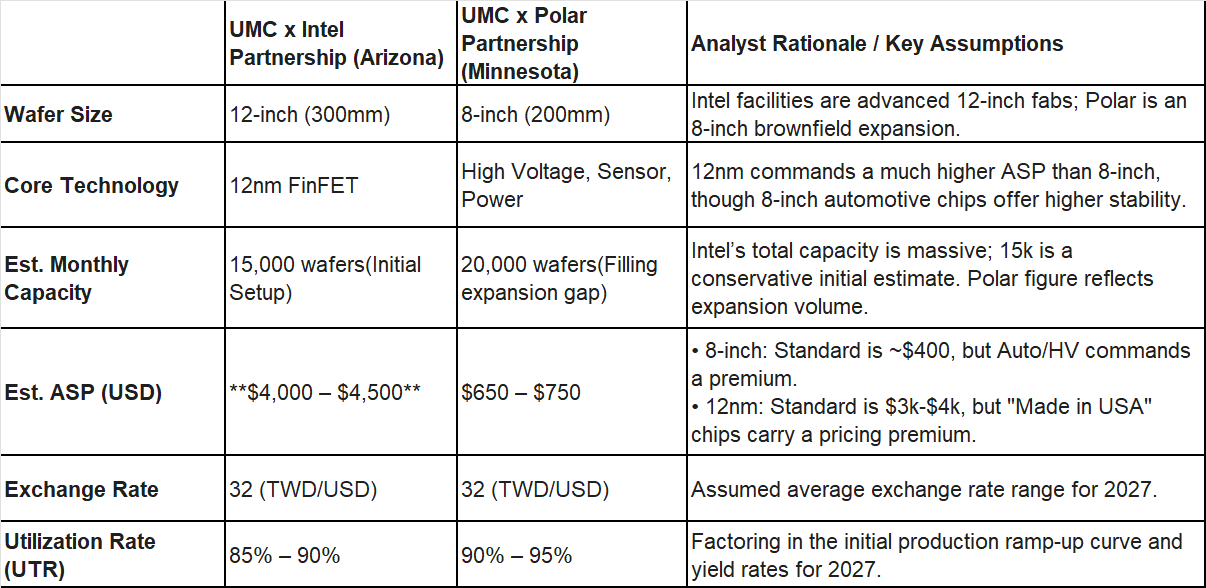

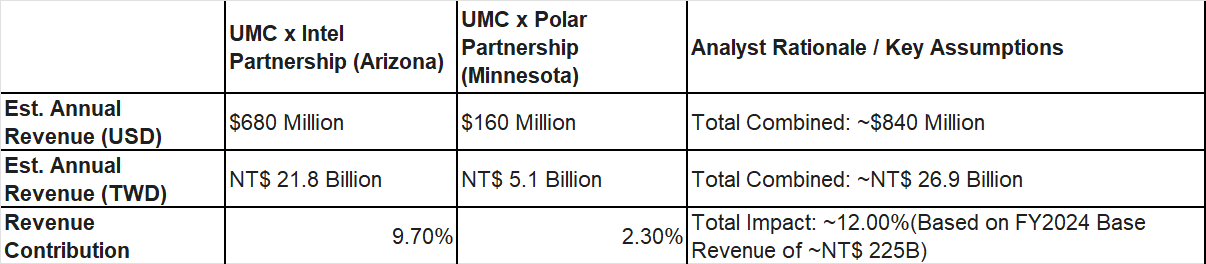

The Financial Impact (The Long Game)

Short Term (1-2 Years): Negligible financial contribution. UMC is not charging licensing fees during the setup phase.

Long Term (2027+): This is where it gets interesting.

Revenue: Potential for NT$25B–30B (approx. US$800M–1B) annually.

Significance: This represents ~10–12% of current revenue.

The Kicker: This revenue is “High Purity” Profit. Since UMC didn’t pay to build the fabs, there is no depreciation drag. It flows straight to the bottom line.

III. The Bonus: Silicon Photonics (SiPh)

The “Hidden Call Option” While the market obsesses over GPU computing, data transmission is the bottleneck. Enter Silicon Photonics.

The Tech: UMC is focusing on PICs (Photonic Integrated Circuits). Unlike logic chips, PICs do not require 3nm processes.

The Edge: Mature nodes (130nm/180nm) are actually better for this—lower cost, lower transmission loss, and higher CP value.

The Partner: Collaboration with IMEC (Belgium) to license the 12-inch iSiPP300 process.

The Timeline:

2026: Pilot Production.

2027: Volume Shipments.

Financial Impact Estimate

The “Pure Profit” Factor: While a 12% revenue boost (approx. NT$27B) is significant, the real story is the quality of these earnings. Because UMC is utilizing existing factories (Intel/Polar) rather than building new ones, there is minimal depreciation drag. This revenue should flow through to the bottom line at a much higher margin than UMC’s standalone fabs.

ASP Premium: Note the estimated ASP for the Intel 12nm node ($4,000+). This reflects the “Geopolitical Premium”—clients are willing to pay more for chips guaranteed to be manufactured on U.S. soil to avoid tariff or supply chain risks.

Risk:What Could Break the Thesis?

1. The “China Drag” on Core Earnings (The Involution Risk)

The threat of commoditization in the mature nodes remains the elephant in the room.

The Scenario: If Chinese foundries (SMIC, Hua Hong) launch an aggressive price war (”involution”) to capture 28nm market share before 2027, UMC’s pricing power will erode.

The Impact: We estimate this could compress UMC’s standalone EPS from ~NT$4.0 to ~NT$3.0.

The Net Result: Such a decline in the core business would effectively neutralize the financial accretion gained from the new U.S. operations.

2. Intel’s Execution Risk (The “Wildcard”)

In my view, this is the single largest variable in the equation.

The Scenario: Intel’s financial health is volatile. Risks include a further deterioration of their balance sheet forcing a divestiture of fab assets, or technical friction during the 12nm technology transfer.

The Impact: If the deal crumbles due to counterparty risk, the projected ~NT$0.60 EPS upside from the U.S. expansion effectively evaporates to zero.

Conclusion

The Analyst Take: UMC is a long-term structural transformation play, not a short-term trade.

Manage Expectations: Do not expect the parabolic stock price action seen in AI hardware component suppliers. This is not an Nvidia proxy.

The Narrative: We are watching a slow-burn decoupling. UMC is gradually exiting the “low-tide” cycle of commoditized price wars and moving toward value-added partnerships.

Conclusion: This thesis requires patience. The “Asset-Light” strategy will take time to reflect in the ROE, but the direction of travel is correct. Wait for the strategy to bear fruit.

Disclaimer:My crystal ball is currently in the shop for repairs. While I believe in this thesis, I cannot predict the future (or what Intel will do next week). I am sharing my notebook, not managing your portfolio. If you make millions, you’re welcome. If you don’t, remember: I’m just a writer on the internet.

Brilliant breakdown of the asset-light play here. The part about UMC avoiding depreciation drag whlie Intel fills idle capacity is genius, basically a win-win where geopolitical hedging meets financial engineering. I dunno if people realize how much the 'Made in USA' premium matters for automotive Tier-1s though, they'll def pay extra to dodge tariff exposure.