Weekly Shots of Insight and Market #1

Memory is the unexpected winner of the AI gold rush. Share some thoughts from Sequoia.

Life & Insight

The weather in Austin has turned cold these past few days, with daytime temperatures around 50°F. It’s been a while since I’ve felt this cool air, and my spirits feel refreshed as well. This week, I watched some interviews from the past six months with Roelof Botha, the Managing Partner of Sequoia Capital, and I had a few takeaways that deeply resonated with me. (I’ll put the links at the end).

Regarding how Sequoia identifies founders, manages capital, and makes decisions in the AI era, I believe it returns to first principles: desire, discipline, and continuous correction. Among these, there are a few points that, as a public market investor and industry researcher, I am also reflecting on:

Founders should be like pirates: Sequoia looks for those “who want to be pirates, not join the navy.” The navy is disciplined and follows orders; but pirates are unconventional, unpredictable, and ignore the rules. Those who change the world often look more like pirates.

Excess capital is poison: After selecting the right founders, the next challenge is providing the right resources. However, Botha presented a most counter-intuitive argument: excess capital is not a resource, but a poison.

Long-term thinking: One must have long-term thinking from the very beginning (which I find extremely difficult). In the early stages, many companies face the risk of burning through all their cash. But at the same time, they cannot be so short-sighted as to only chase short-term opportunities. They need a long-term vision for product and business development. This balancing act is a challenge every founder must confront.

Working in the investment research industry, the problem I need to solve for clients is how to maximize capital efficiency at the lowest possible risk. Besides identifying good prices, recognizing good corporate value, and taking action, after watching these interviews, I am also reflecting on whether I, in this role, possess a “pirate spirit,” long-term thinking, and whether I have become too comfortable.

In the AI era, the speed at which capital markets are expanding rivals the speed of technological iteration. There are even more temptations for people to leverage or go “All in” in the stock market, while lacking real productivity. After all, something produced today might be replicated by someone else in a few days or weeks.

My own investment research is the same. I track industry news and technological changes daily, and AI has accelerated the speed and breadth of information flow. But AI is in the process of commoditizing the “technology” aspect of products (making it less valuable). The Sequoia interview mentioned a very important point: return to the fundamentals. Value is shifting from “code” back to the fundamentals of business:

Deep understanding of customer needs: You understand the customer’s workflow and pain points better than anyone.

Distribution capability: How do you reach the first 100 paying users in 30 days?

Product stickiness: How do you create switching costs for users?

Speed of brand building: How do you quickly become synonymous with a certain product category?

When technology itself becomes cheap and ubiquitous, those “old-fashioned” business fundamentals—sales, marketing, customer service, and brand—conversely become more important than ever.

Finally, there’s “passion” and “discipline,” which I also care deeply about. These viewpoints from Sequoia all seem to point to the same core: companies that can internalize this discipline into their own operating system, and deliver their passion to the world, will be the survivors that create lasting value. While doing research, I often remind myself to keep reading daily, exchanging ideas with talented people, learning new technologies, and reading history—to do this for a lifetime and enjoy the process.

I hope to continue building a deep foundation, one that can withstand the fierce winds of market cycles, and to continuously grow upwards, seeking new light.

Market

High probability of a December rate cut; the Fed is currently just managing market expectations.

First, from a macroeconomic perspective, Powell sent a very important signal at this press conference: AI capital expenditure is almost unaffected by interest rate policy in the short term. The growth of the AI industry no longer depends on the cost of capital but is driven by technological innovation and structural demand. This also implies that the U.S. economy is entering a new productivity cycle centered on AI.

The Fed cut interest rates and, starting in December, will no longer reduce its balance sheet (QT). This is good news for market liquidity.

Chairman Powell came out to “cool things down,” hinting that another cut in December is not certain: Although rates were cut, Chairman Powell specifically emphasized at the press conference that the labor market is only cooling “gradually” and is not yet in a bad state. He hinted that a rate cut in December is “not inevitable” and will depend on subsequent data, with the goal of preventing the market from getting over-excited.

Insightology View: The probability of a December rate cut is still high. Powell is currently just “managing market expectations” to prevent the market from becoming too euphoric. We believe that as falling oil prices help cool inflation, it is still very likely the Fed will cut rates again in December. Short-to-medium-term US Treasuries may also have an opportunity for good performance in the future.

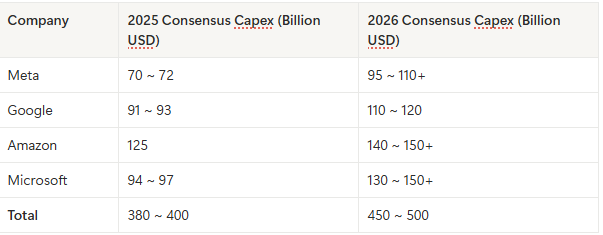

Major CSPs’ Operating Cash Flow Can Still Support Upward Revisions to 2026 Data Center Capex YoY

This week, all four major CSPs held their third-quarter earnings calls. Several key points include: all four raised their capital expenditure forecasts for 2025 and continued to increase investment in AI.

If you look at their operating cash flow, it can still support current and future large-scale investments in AI/data centers:

Meta’s average quarterly operating cash flow is about $25 billion; the TTM (Trailing Twelve Months) announced in Q3 2025 was approximately $102 billion.

Google’s (Alphabet) TTM operating cash flow announced in Q3 2025 was approximately $133.7 billion.

Amazon’s TTM operating cash flow announced in Q3 2025 was approximately $130.7 billion.

Microsoft’s latest TTM figure is approximately $122 billion, with the most recent four quarters each maintaining roughly $30 billion.

In fact, because their operating cash flow remains sufficient, there is still a possibility they will raise (or upwardly revise) next year’s Capex. Although the market may worry about free cash flow being squeezed, these major CSPs must sacrifice short-term free cash flow right now in order to win the AI race.

Insightology View: Although Meta’s and MSFT’s short-term results did not meet expectations, I believe these major companies all have the opportunity to catch up quickly. Remember last quarter, everyone was saying Amazon’s AWS growth was lagging behind its peers, but after just one quarter, everyone has become optimistic again.

Among these, electricity is also a key focus this time. Amazon stated in its earnings call that it added 3.8 GW of power capacity TTM (Trailing Twelve Months), which is double the 2022 level, and it expects to double this again by 2027. It also expects to add another 1 GW of power in the last quarter of this year. We also published an article on 800V HVDC last week and will continue to provide updates on the industry’s status.

Andrew Jassy - President, Chief Executive Officer, Director:

Yeah. On the capacity side, we brought in quite a bit of capacity, as I mentioned in my opening comments, 3.8 gigawatts of capacity in the last year with another gigawatt plus coming in the fourth quarter and we expect to double our overall capacity by the end of 2027. So we’re bringing in quite a bit of capacity today, overall in the industry, maybe the bottleneck is power. I think at some point, it may move to chips, but we’re bringing in quite a bit of capacity. And as fast as we’re bringing in right now, we are monetizing it.

Memory Industry: AI Video Demand is Poised for an Outbreak; 2026 Demand Growth Rate Will Be Stronger Than Expected

HDD Demand Outlook Sharply Raised: Major HDD players (such as STX, WDC) have significantly raised their demand outlook for the next 4 to 6 quarters.

Main Driver: The primary reason for the surge in demand is driven by AI inference needs, particularly the expansion of AI-generated video. This is causing large cloud service providers (Hyperscalers) to accelerate procurement. This differs from past demand models that relied on non-AI data growth or cyclical server refreshes.

Upward Revisions from Players:

Western Digital (WDC): Raised its 2026 bit demand growth forecast to over +23% (up from +20%), with order visibility extending into early 2027.

Seagate (STX): Expects 2026 bit demand growth to reach the “mid-20s” (i.e., mid-20% range), with order visibility extending from late 2026 to early 2027.

William Mosley - Seagate CEO:

AI-generated videos promise to further fuel demand growth. There are already numerous text-to-video tools that democratize creativity by letting anyone generate professional quality videos from text, images or sketches. We see this trend already taking hold. For example, Google reports over 275 million videos were generated on its Bio platform within the first 5 months. With a 1-minute AI video being up to 20,000 times larger than a 1,000 word text file, the data storage implications are clear. The rapid adoption and growing capability of these tools are already having a positive impact on the demand for storage.

NAND Flash: Benefiting from High-Capacity HDD Shortages, Enterprise SSD Substitution Demand Continues into H1 2026

Short-term Positive (Continuing into H1 2026): Due to shortages of high-capacity HDDs (traditional hard drives), data centers are turning to procurement of high-capacity QLC enterprise SSDs (solid-state drives) as a substitute. This has led to a significant increase in NAND Flash demand.

HDD supply is not expected to improve until H2 2026 at the earliest. Therefore, the substitution demand for SSDs will continue until at least H1 2026.

This strong substitution demand is expected to offset the decline in consumer demand, allowing NAND Flash to show better-than-seasonal performance in the typically weak H1 2026 (i.e., “the off-season won’t be slow”).

Long-term Concern (Starting H2 2026): This current wave of strong demand for enterprise SSDs is primarily triggered by the HDD shortage.

Once high-capacity HDDs using HAMR (Heat-Assisted Magnetic Recording) technology begin mass production in H2 2026 to H1 2027, the HDD shortage issue may be alleviated.

At that point, it will be necessary to continuously monitor whether the restored balance in HDD supply will, in turn, weaken the substitution demand for enterprise SSDs.

View from Major Memory Equipment Makers: Upward Revisions for Memory Equipment Procurement Demand Will Be Stronger Than for Logic Equipment

AI Demand Surge Offsets Negative Impacts: Benefiting from the surge in end-market AI demand in Q3 2025, it is sufficient to offset the impact of declining semiconductor equipment procurement demand from China.

Major Equipment Makers Raise Outlook: ASML raised its 2026 outlook from “flat” to “no lower than 2025.” Lam Research (LRCX) expects revenue growth to continue into H2 2026.

Data Centers Driving Growth: Lam Research estimates that every $100 billion in data center investment drives approximately $8 billion in additional semiconductor equipment spending. Considering that data center investment next year (2026) may increase by $80-$100 billion compared to this year (2025), this could contribute an additional $6.5-$8 billion in semiconductor equipment spending. This is equivalent to contributing an extra 6-7 percentage points of growth momentum, making it possible for the 2026 semiconductor equipment industry value to maintain over 10% growth.

VEU Revocation Impacts Memory: The US revocation of VEU (Validated End-User) authorization for Samsung’s and Hynix’s fabs in China restricts their ability to expand or upgrade advanced processes there. This has a huge impact on the supply of advanced NAND and DRAM processes.

Memory Equipment Demand is Strongest: The VEU restrictions, combined with the AI demand surge, will force Samsung and Hynix to accelerate the expansion of advanced memory capacity outside of China. It is expected that the upward revision for 2026 memory equipment procurement demand will be stronger than that for logic equipment.

Market Signal Corroboration: In ASML’s new orders last quarter, memory-related orders grew +186% quarter-over-quarter (QoQ), significantly higher than logic-related orders.

Most of this week’s information was heavily focused on memory. However, I believe that AI Server PCBs (Printed Circuit Boards) are the next key area to watch, and I will be analyzing this topic in the coming one or two weeks.

My own personality isn’t suited for being an aggressive pirate, plundering other people’s territories or resources. I much prefer to observe and predict the ocean currents and, taking it a step further, to help others follow these currents together as we all advance toward the great voyage. - Insightology Research

What I Read

Transcript

Seagate_STX 25Q3 Earnings Call Transcript

WDC 25Q3 Earnings Call Transcript

SK Hynix 25Q3 Earnings Call Transcript

Lam Research_LRCX 25Q3 Earnings Call Transcript

KLAC 25Q3 Earnings Call Transcript

Meta 25Q3 Earnings Call Transcript

MSFT 25Q3 Earnings Call Transcript

AMZN 25Q3 Earnings Call Transcript

Youtube

Lessons from 20 Years of Venture Capital: Roelof Botha (Managing Partner at Sequoia Capital)

Sequoia’s Roelof Botha on Decision Making, AI, and the Next Trillion Dollar Markets | Ep. 28

Roelof Botha on PayPal Panic & Sequoia’s Long-Term Strategy | The Library of Minds

Sequoia’s Roelof Botha: Why Venture Capital is Broken & How Great Companies Are Built

Book

On Writing Well: The Classic Guide to Writing Nonfiction (Continue Reading)

The “pirates not navy” mindset captures what’s driving innovation, while the reminder that excess capital is poisonous grounds the idea in discipline. At least that's what I got. I liked how you tied Sequoia’s philosophy to the AI cycle, too, where speed and liquidity can tempt recklessness.

Didn't expect this take on startup founders, especially 'pirates not navy'. It's counter-intuitive but makes you think! Thanks for connecting these insights to the AI era, really valuabel.