Weekly Shots of Insight and Market #6

The Art of Slowing Down; Credo Targets Short-Reach with ALC; AWS Trainium 4 Embraces Nvidia NVLink

——-

Life: Efficacy, Slow Living, and the Fear That Drives Us

The Distinction Between Efficiency and Efficacy

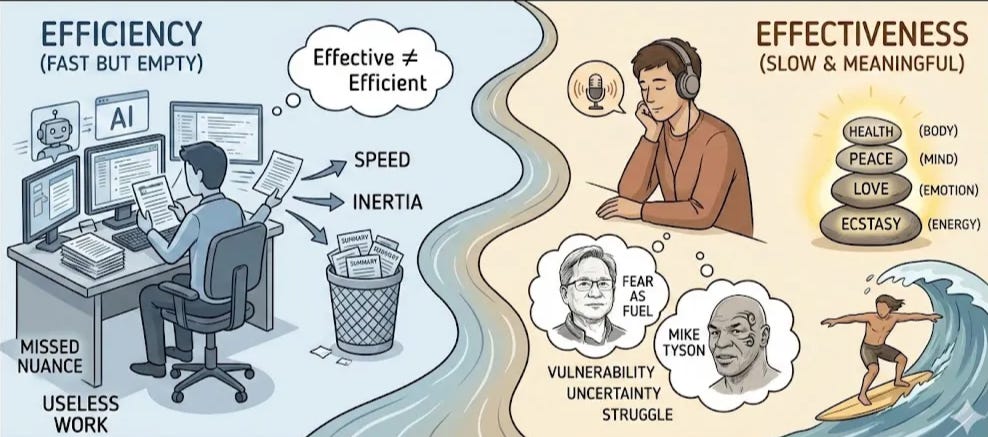

This week, while using AI tools, I had a major realization: being efficient is different from being effective. Both are important, but from the perspective of achieving goals, the primary focus should be on efficacy. Getting things done quickly isn’t necessarily useful; sometimes it’s just fast.

In life, the more important the matter, the less you need to chase efficiency. For things you genuinely enjoy, you should pursue slowness, prolonging the enjoyment of the process. Sometimes, high speed becomes a habit and creates a shield, ignoring the truly important parts, which might ultimately result in a lot of useless work, rendering the efficiency pointless.

AI will significantly change work efficiency, but whether it is effective primarily depends on the human user. I recently found that using AI to summarize long articles or podcasts often yields only dispensable/non-essential information. Moreover, many people online already help shorten and highlight the main points, which you repeatedly encounter. For example, the main impressions I had after listening to Jensen Huang on Joe Rogan today were not the ones provided by the AI summaries. The feelings and insights gained from listening to the whole thing without an AI summary were completely different from the text later summarized by the AI.

Fear: The Common Driver Behind Success

Especially Jensen’s interview reminded me of a previous interview I saw with Mike Tyson and Sadhguru. Jensen mentioned that he is driven by fear, not greed. Both of them came from challenging environments and transformed these experiences into later achievements.

• Jensen Huang‘s parents sent him and his brother to the United States, where he spent time in a school in one of America’s poorest counties (Clark County, Kentucky).

• Mike Tyson grew up in an environment filled with bad things (such as witnessing death and prostitutes).

Both admitted that fear, anxiety, and struggle were constant states throughout their careers. Jensen Huang confessed that his drive stems more from the motivation not to fail than the motivation to succeed. He wakes up every morning feeling anxious, worried that the company might soon collapse. This “sense of vulnerability, the sense of uncertainty, the sense of insecurity“ has never left him. Mike Tyson also said that despite being considered one of the “Toughest guys in the world,” he confessed to Sadhguru that he has been afraid his entire life. Even now that he is successful, he cannot pinpoint exactly what he is afraid of.

From the two of them, we can see that the journey of life is like surfing; you cannot predict the waves, but you must possess the skills to handle the existing ones. Mike Tyson’s life journey also reflects this, as Sadhguru once commented that without maintaining balance, talent and ability can eventually turn against oneself.

The most important lesson for me, as someone who recently arrived in the U.S., is cultivating balance and the sense of life’s pleasantness. The pleasantness of the body is health; the pleasantness of the mind is peace; the pleasantness of the emotion is love; and the pleasantness of life energy is ecstasy. If we do not make our minds and emotions pleasant and peaceful, then we cannot feel happiness even when enjoying dinner or taking a walk down the street

Market: AI Industry Strategy, Acquisitions, and the Competitive Landscape

1. Credo Launches ALC to Disrupt Mid-to-Short Distance Market; BizLink Strategically Acquires New Fusheng

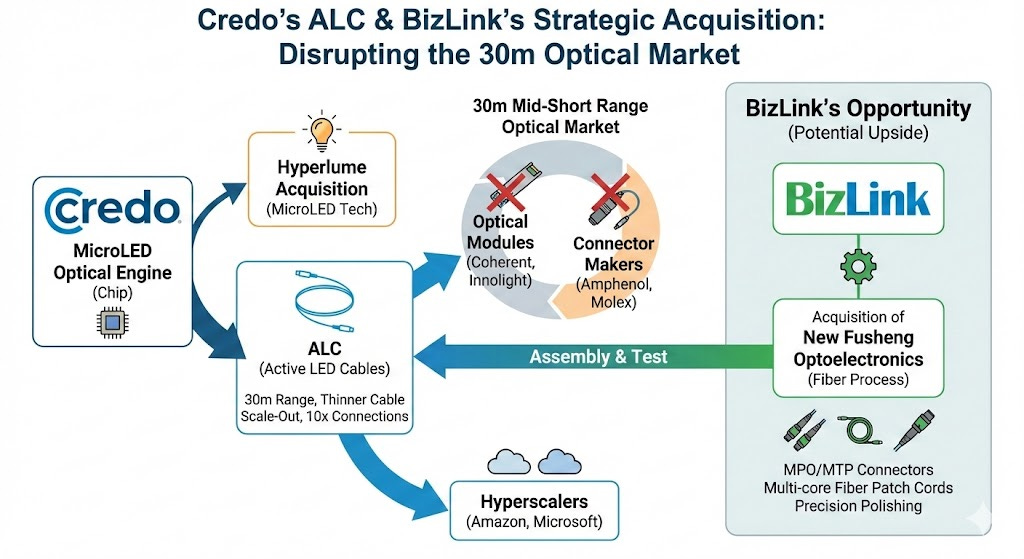

Credo launched ALC using MicroLED technology to disrupt the mid-to-short distance optical transmission market within 30 meters, while BizLink (貿聯) supplemented key optical fiber manufacturing processes through the acquisition of New Fusheng, positioning itself to be a major beneficiary of this potentially huge business opportunity.

During this conference call, Credo announced the new product line ALC (Active LED Cables). I personally believe this represents potential upside for BizLink (which the market has not priced in). This area could potentially erode the market share of optical module manufacturers in the mid-to-short distance range (30m).

ALC Product and Strategy:

• Business Model: The business model for ALC is exactly the same as for AEC (Active Electrical Cables): Credo provides the core chip (MicroLED optical engine), which is then handed over to the cable manufacturer for packaging, testing, and assembly, and finally sold under the Credo brand to Amazon or Microsoft. The probability of switching contract manufacturers is low because this requires validation by the CSPs (Cloud Service Providers).

• Technology & Scope: ALCs combine the MicroLED technology from the previously acquired company, Hyperloom. ALCs are expected to provide the same reliability and power consumption characteristics as AECs, but with a thinner wire gauge and lengths up to 30 meters.

• Market Growth: The network scale will expand from inter-rack to inter-row. The number of connections is expected to reach 10 times that of AEC, with room for increased ASP. This is highly suitable for row-level (scale-out) expanded networks.

• Timeline and TAM: Sampling to major customers is projected for FY2027, with preliminary volume production starting in FY2028. The TAM (Total Addressable Market) for ALC is eventually expected to be more than double the TAM for AEC.

Analysis of the Hyperlume Acquisition: Hyperlume, a startup specializing in MicroLED optical interconnect technology, completed its transaction at the end of September 2025. Hyperlume holds the core technology and intellectual property for ALC. Therefore, Credo will directly offer ALC solutions to its customers (primarily Hyperscalers such as Amazon and Microsoft).

Notably, Hyperlume founders Nadeem Mirza was Credo’s former VP of Product, and Parker Robinson was Credo’s former Director of System Engineering. The strategy was to allow former employees familiar with the company’s strategy to leave and establish a startup (Hyperlume), using external venture capital (such as Intel Capital, LG, EIC) for funding and experimentation. Once the technology was successfully validated (that MicroLED was truly viable), Credo then funded the buyback. If developed internally at Credo, the project might have failed due to financial reporting pressures or the prioritization of other R&D resources.

BizLink’s Strategic Move: This presents competition for major optical communication module manufacturers (Coherent, Innolight) and major cable manufacturers (Amphenol, Molex). These companies currently supply large volumes of 400G/800G optical modules and AOCs to Hyperscalers. If ALC succeeds, it will directly erode their market share in the “mid-to-short distance (within 30 meters)“ segment.

The risk for BizLink to watch out for is whether a second connecting cable manufacturer capable of providing fiber optic capabilities—such as Amphenol or Molex—will enter the market.

BizLink announced this week the acquisition of New Fusheng Optoelectronics (New Fusheng Optoelectronics), specifically to strategically position itself for ALC. New Fusheng is an enterprise with a “Taiwanese capital background“ (wholly owned by Taiwan, Hong Kong, or Macau corporate entities). New Fusheng provides OEM/ODM manufacturing for Corning, CommScope, and other optical communication brands.

• Technology Requirement: ALC (Active LED Cable) combines a MicroLED chip with fiber optic bundles. ALC needs to use high-density fiber optic bundles to transmit the optical signal emitted by the MicroLED.

• New Fusheng’s Strength: New Fusheng’s strength lies in specializing in the manufacturing of MPO/MTP high-density fiber optic connectors and multi-fiber patch cords. New Fusheng possesses the mass production capability to precisely align multiple optical fibers and package them into a connector. (The most technically difficult aspect is polishing the connector end face to a specific angle to prevent light reflection back, which would interfere with the laser).

• Strategic Significance: While BizLink is very strong in AEC, the precision polishing and alignment of fiber optics is a completely different process. Therefore, by acquiring New Fusheng, BizLink avoids having to build a fiber optic factory from scratch and directly obtains the necessary fiber assembly capacity for ALC.

2. AWS Trainium 4 Adopts Nvidia NVLink Fusion/NVSwitch

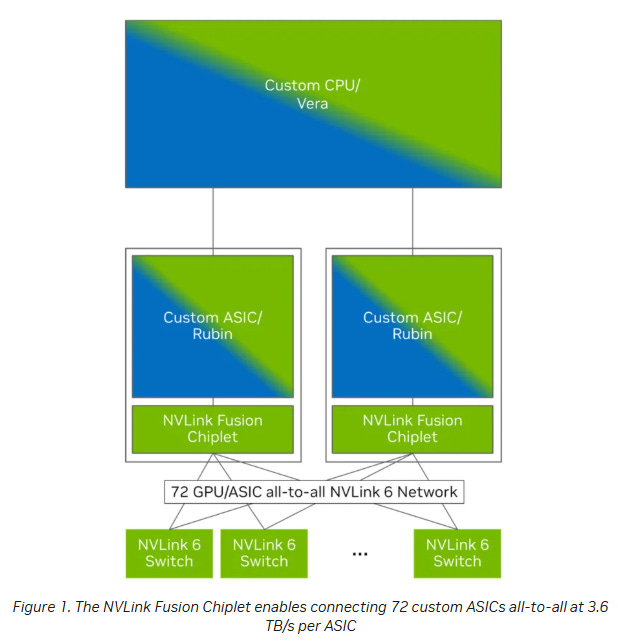

AWS re:Invent announced this week that Trainium 4 will adopt Nvidia’s NVLink Fusion technology for chip-to-chip interconnection. This move not only allows Nvidia to successfully penetrate the AWS ecosystem with NVSwitch hardware, earning substantial revenue, but also severely squeezes the living space for third-party Switch suppliers like Broadcom.

The Shift to XPU-to-XPU Interconnect: Previously, when Nvidia licensed NVLink C2C to CPU manufacturers like Intel or Arm, the focus was embedding the IP inside the customer’s CPU to connect the CPU with the GPU/XPU. In these scenarios, a standalone Switch chip was usually not required, nor was it related to “Scale Up” (vertical scaling). However, AWS’s focus this time is completely different: AWS chose NVLink Fusion to handle high-speed interconnection between “XPU-to-XPU,” which is the core “Scale Up“ requirement.

In this solution, Nvidia will provide a small NVLink Fusion Chiplet, allowing the customer’s Trainium 4 chip to be integrated into the package. The main function of this Chiplet is to enable the customer’s XPU to communicate with the standard NVSwitch chip.

Nvidia’s Business Logic: Nvidia’s business logic is very clear: selling IP licensing fees is a small matter. For Nvidia, the largest contribution and source of revenue is the sale of expensive NVSwitch chips or Trays/Boxes.

We can divide the Switch functions in AI systems into three categories:

1. CPU-to-XPU Switch: Responsible for communication between the CPU and the AI processor.

2. XPU-to-XPU Switch (Scale-Up Switch): Responsible for high-speed interconnection between AI chips (this is the core market targeted by NVSwitch).

3. Networking Switch (Scale-Out Switch): Responsible for network communication between racks or clusters.

AWS’s Trainium 4 chose to use NVSwitch for category (2), which is the Scale-Up of XPU-to-XPU. In this segment, Nvidia’s NVSwitch product constitutes the “all green“ portion, meaning the customer has no room for customization or choosing third-party products.

Market Impact and Timeline: This constitutes a huge impact on third-party chip suppliers. Whether they provide PCIe Switches for scale-up or Broadcom’s Ethernet Scale Up Switch, they will all be affected or even replaced by NVSwitch in the XPU interconnection market for Trainium 4.

According to Nvidia’s own GB200/300 NVL72 design ratio, the ratio of GPUs to NVSwitches is approximately 4:1. This means that if AWS Trainium 4 shipments are substantial, Nvidia could sell hundreds of thousands of NVSwitch chips.

However, Trainium 4 will not be available until 2027 at the earliest. In 2026, the market will still be dominated by Trainium 3, and the XPU interconnection technology used then might still be AWS’s proprietary NeuronSwitch or third-party PCIe Switches.

What I Read

Transcript

Credo Earnings Call Transcript

Marvell Earnings Call Transcript

The ALC play by Credo is really interesting since it opens up a completely new market segment for the 30m range using MicroLED instead of traditional optical modules. The bit about BizLink acquiring New Fusheng for fiber optic assembly makes perfect sense because that precision polishing capability is super specialized. On the AWS Trainium 4 side, Nvidia basically locked in the XPU scale-up market with NVSwitch which squeezes out Broadcom and other third-party switch vendors pretty hard.