Weekly Shots of Insight and Market #7

Equanimity & Long-termism ; AI & Horses ; CoWoS Capacity Update ; Optical Module Tracking

Hi everyone, how was your week?

This week was also a busy one. I attended several analyst conferences, busy compiling data, and during the process, I also reflected on some of my mistakes this year and areas for correction, and have been continuously organizing our outlook for 2026.

I am also very grateful to Andrew Lu for sharing our earlier articles. This week, the number of followers also exceeded 100 people. This column will continue to record observations and reflections on technology, life, and investment. Seeing that people are following the articles I write for the first time gives me a feeling of affirmation.

Life: Long-Termism

• Recently, I watched two interview videos with Chinese investor Duan Yongping. He rarely gave public interviews over the past few years, but in the last few months, he has appeared twice. The biggest takeaway was the reminder to return to “Long-Termism” and the “Normal Mindset” (Ping Chang Xin).

• For US investors, this investor—Duan Yongping—might be unfamiliar. He was the first Chinese person to win the bid for lunch with Warren Buffett and is the founder of China’s Bubugao and Xiaobawang (the parent company of the mobile phone brand Vivo). After 2000, Duan Yongping chose to retire, stepping away from day-to-day management (which has been over 20 years now), living a “normal” life primarily focused on playing golf and exercising. Although he let go of the businesses, the corporate culture he established (rationality, integrity/doing the right thing, consumer orientation) continues.

• In the US, one of his funds, H&H International Investment, currently manages US stock holdings worth approximately $14.7 billion.

• He mentioned that the core essence is the “Normal Mindset” (Ping Chang Xin) and “integrity/doing the right thing” (Ben Fen). The “Normal Mindset” is truly not easy because the premise of having a Normal Mindset is “Long-Termism,” thinking rationally about the long run. It is difficult for truly ordinary people to maintain a Normal Mindset because people are easily swayed by various external temptations and short-term returns.

• Although in the interview he admitted to being a “lazy person,” always having “no great ambitions,” and just wanting to live each day well, he emphasized that finding what you love to do is extremely important. If you don’t like what you are doing, you must try hard to like it to find enjoyment and do the job well, which means doing the right things (Dao) plus doing things right (Shu). I believe this is his Normal Mindset.

• For me, writing, investing, business, and building products are all things I enjoy. Even if there were no AI today, I would still continue to do these things. However, it is inevitable that due to drastic short-term changes, new “stock market prodigies” emerging every year (young or middle-aged), new products, or news about who raised how much money, one might forget the Normal Mindset.

• “The Great Dao is simple” (Dà Dào Zhì Jiǎn) is also his core concept, which is quite similar to Charlie Munger’s core concepts.

• In business, “subtraction” means focusing on core businesses and eliminating unhealthy, unsustainable temptations, concentrating on core value (building a healthier, longer-lasting enterprise or life).

• When making decisions, prioritizing whether something is the right thing to do comes before “whether there is money to be made”.

• In investing, if you don’t understand it, resolutely don’t touch it. His margin of safety in investing is not about a low price, but rather how deeply one understands the company. If you cannot deeply understand the operational reality of an enterprise, you must restrain from investing.

• Focus energy on the few things that can be deeply understood and done well, and firmly eliminate all tempting or incorrect options that do not conform to the principle of “integrity/doing the right thing” (Ben Fen). As he said: “The main reason we are who we are is because of the things we don’t do.”

• Insightology also hopes to continue building a deeper understanding in technology and business and become a healthier, longer-lasting enterprise, not just through articles, but by implementing it in our lives.

AI and Horses, Bubble?

• Technological progress is linear (or exponential but steady), but the moment “replacement” occurs is sudden.

• This week, I read an article by Andy Jones, which mentioned analogies for the replacement of tools through the emergence of the steam engine, computer chess, and artificial intelligence.

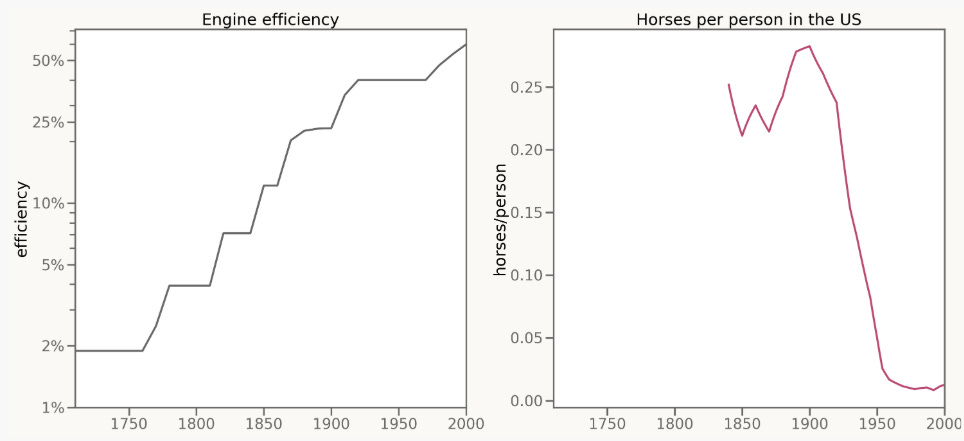

• The engine was invented in 1700. Over the next 200 years, engine technology steadily improved, increasing performance by 20% every decade. During the first 120 years of steady improvement, horses hardly noticed any change. Subsequently, between 1930 and 1950, 90% of horses in the US disappeared. The development of the engine proceeded steadily, but the moment it rivaled the performance of horses happened suddenly.

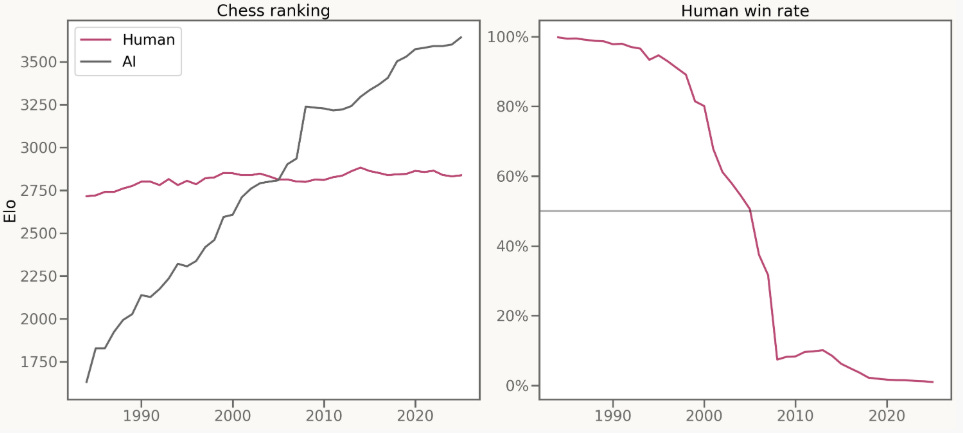

• Now let’s look at recent chess. People started paying attention to computer chess in 1985. Over the next 40 years, the rating of computer chess improved by 50 points annually. This meant that in 2000, human International Chess Grandmasters had a 90% chance of winning against a computer. But ten years later, when the same human Grandmaster played against a computer, the probability of losing was as high as 90%. The development of chess was steady, but reaching parity with human capability was sudden.

• Capital expenditure in the field of artificial intelligence has been quite stable. Currently, global annual spending on AI data centers is equivalent to 2% of US GDP. This figure seems to have been steadily doubling over the past few years. Based on signed agreements, this number is highly likely to continue doubling in the coming years.

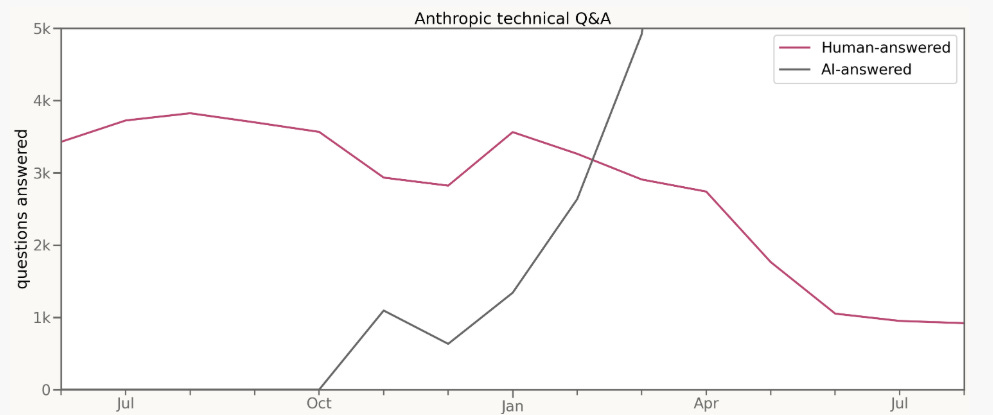

• The author was one of the earliest researchers hired by Anthropic. A significant part of the author’s work in 2024 was answering technical questions from new hires. At that time, the author and other senior employees answered about 4,000 questions from new hires every month. By December, Claude’s level was finally high enough to answer some of our questions. In December, such questions indeed existed. Six months later, 80% of the questions the author was asked had disappeared.

• The summary of the article is that the author believes that the progress of technology is accelerating, and the act of “replacement” is becoming increasingly sudden, whether for horses, International Chess Grandmasters, or AI researchers. It took decades for horses to be surpassed, years for Chess Grandmasters, but researchers were surpassed in just six months.

Insightology View

• AI drives the cost of intelligence towards zero, which is not good for employees, but for entrepreneurs, it may provide significant profit margins. However, for already established companies, we believe they must embrace AI, and the sooner the better, just as the author’s article suggests: technological progress seems steady, but replacement is sudden.

• But for investors, there is no need to debate whether the technology is strong enough; instead, they should focus more on “whether the price is reasonable” and the “cyclicality of human behavior,” because history does not repeat itself, but it rhymes.

• After reading Andy Jones’ article, the chart is terrifying, showing a future that is ‘linear and inevitable,’ but it ignores the power of capital cycles. Looking at Howard Marks’ article, I personally believe Andy Jones’ piece is full of the fear of “missing out on the future”. However, this collective FOMO (Fear of Missing Out) is precisely the psychological basis for bubble formation. When everyone believes that “humanity is doomed” and sells off human assets (such as traditional companies, skills education) to chase AI, human assets might paradoxically become valuable due to being excessively undervalued.

• Certain bubbles (like AI) will leave behind infrastructure that changes the world, but even if the outcome is that AI changes the world, the process will be accompanied by massive capital destruction. After the 2000 dot-com bubble burst, Amazon fell 90% before re-emerging.

• Railways changed the world, but most early railway investors went bankrupt; the internet changed the world, but those who bought in 1999 lost their life savings. Although we might truly be the ‘horses,’ if the market has already driven the price of ‘horse meat’ down to zero and inflated the price of the ‘engine’ to sky-high levels, then as an investor, I would rather buy undervalued human assets during panic than chase overheated AI during euphoria. Trees don’t grow to the sky; cycles always return.

• The “physical reality” of technology and the “financial reality” of the market are two different things. Even if humanity is destined to be replaced, this process will definitely not be a straight line, and it must involve massive bubble bursts and value re-assessment.

AVGO Conference Call

• We believe the market over-interprets short-term stock price fluctuations. Setting aside the stock price, from an industry perspective, Broadcom is transforming from a pure chip supplier to directly providing complete cabinet-level solutions. This solution, besides the XPU, also includes back-end components like switches and optical communication, and may be priced as an entire cabinet, thus affecting the gross margin.

• Some market commentators discussed that the gross margin figures were lower than expected. We believe this is an unreasonable assertion because anyone with a normal mind knows that switching from selling chips to selling cabinet solutions will inevitably lower the gross margin, but the company can earn more money. We do not view this as negative news.

• This conference call re-confirmed that the biggest current bottleneck for AI chips is packaging. This verifies previous supply chain observations, where many orders flow to external OSAT factories (back-end assembly and testing plants) when TSMC cannot fully meet demand. The following two paragraphs are some conclusions from our research this week.

• “ That’s an interesting challenge that we have been addressing constantly and continue to, and with the strength of the demand and the need for more innovative packaging, advanced packaging, because you’re talking about multi-chips, multi-chips in creating every custom accelerator now, the packaging becomes a very interesting and technical challenge. Building our Singapore fab is to really talk about partially insourcing those advanced packaging. We believe that we have enough demand. We can literally insource not from the viewpoint of not just cost, but in the viewpoint of supply chain security and delivery. We’re building up a fairly substantial facility for packaging, advanced packaging in Singapore, as you indicated, purely for that purpose to address the advanced packaging side. Silicon-wise, no, we go back to the same process source in TSMC, and so we keep going for more and more capacity in 2 nm, 3 nm.”

TSMC CoWoS capacity

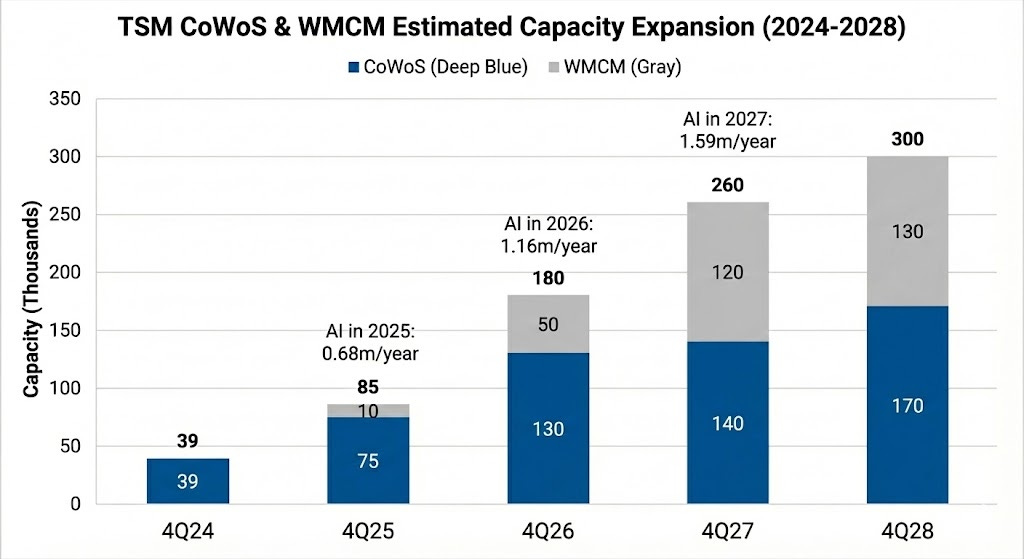

• This week, we have some research and updates regarding TSMC’s CoWoS capacity. TSMC’s Tainan Science Park (Nanke) AP8 plant and Chiayi AP7 plant are scheduled to begin equipment installation in the fourth quarter of 2025.

• Estimated CoWoS advanced packaging capacity is expected to be approximately 75,000–80,000 wafers/month by the end of 2025. The capacity target for the end of 2026 has been revised upwards from the original 110,000–120,000 wafers/month to 120,000–130,000 wafers/month, and 140,000–150,000 wafers/month by the end of 2027.

• The CoWoS capacity forecast was recently raised in early December. TSMC continued to place orders with CoWoS equipment suppliers from the end of October to the end of December. Due to the long delivery lead time of Japanese equipment (7 to 8 months), plus 1-2 months for order adjustments, this batch of orders is expected to commence production in the fourth quarter of next year. This wave of CoWoS capacity increase is expected to be the last significant growth in 2026.

• Despite the capacity revision, it still cannot fully meet customer demand. To address this issue, some products with simpler RDL structure designs will gradually be outsourced to professional outsourced testing and assembly (OSAT) firms. Furthermore, TSMC is internally studying the transfer and outsourcing of the Flip Chip Bump process to free up factory space for further expansion of Cu Pillar Bump process stations. Future CoWoS advanced packaging capacity might potentially increase by another 10,000–20,000 wafers/month.

• Main Corresponding Downstream Customers

• The capacity increase is mostly allocated to NVIDIA. The expected production capacity for Rubin plus Blackwell in 2026 has been revised upward to 650K (originally 580K). Broadcom’s monthly capacity continues to be revised upward, currently viewed at 240K (about 180K allocated to Google), with subsequent revisions of 10K every 1-2 months. MediaTek (MTK) capacity for 2026 is expected to be revised upward to 100K. AWS is requesting CoWoS-R capacity from ASE.

Second Supply Chain

• Clients are actively establishing a second supply chain besides TSMC, prompting professional outsourced testing and assembly (OSAT) firms to significantly increase advanced packaging capacity and begin entering the front-end CoW process.

• ASE Technology Holding (including SPIL): It is expected to undertake orders for TSMC-like production lines and utilize the clients’ self-built second production line. It is anticipated that by the end of 2026, advanced packaging capacity will expand from 7,000–8,000 wafers/month to 20,000–25,000 wafers/month.

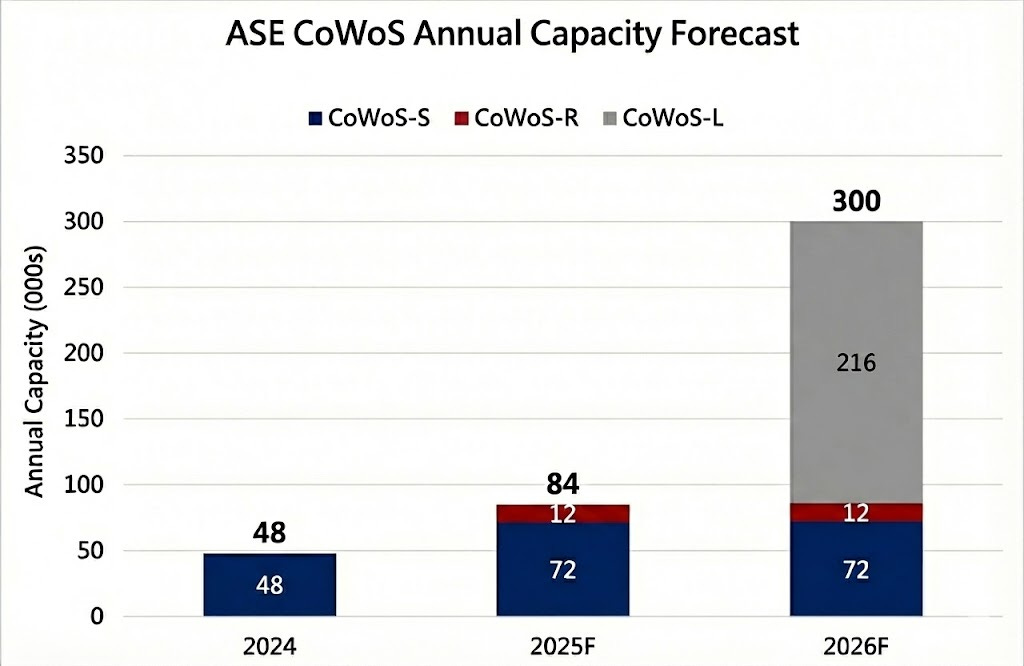

ASE Technology Holding Total CoWoS Advanced Packaging Capacity

• 2024: Approximately 4 kwpm (primarily CoWoS-S)

• 2025F: Approximately 7 kwpm (Slight increase in CoWoS-S, small addition of CoWoS-R)

• 2026F: Approximately 25 kwpm (Significant growth, CoWoS-L ratio increases notably, followed by CoWoS-S and CoWoS-R)

• Google: The next-generation TPU v8p (Zebrafish) will also continue to adopt CoWoS-S advanced packaging, expected to be launched in the second half of 2026. Google will jointly design the silicon interposer with Powerchip Semiconductor Manufacturing Corp. (PSMC) as the second supplier, and since the patent of AP Memory (AIP) is used, licensing fees must be paid to AIP. Subsequently, ASE and SPIL will be responsible for the front-end CoW process.

• AMD: The Epyc Venice CPU adopts CoWoS-L advanced packaging. Because the RDL structure is relatively simple and does not involve the TSV process, part of the orders will use ASE and SPIL as the second supplier.

• Amkor: NVIDIA Vera CPU adopts CoWoS-R advanced packaging. Because the RDL structure is relatively simple and does not involve the TSV process, Amkor will serve as the second supplier for the front-end CoW process, while part of the subsequent oS process orders will be outsourced to ASE and SPIL

Optical Communications: 1.6T and CPO Architecture

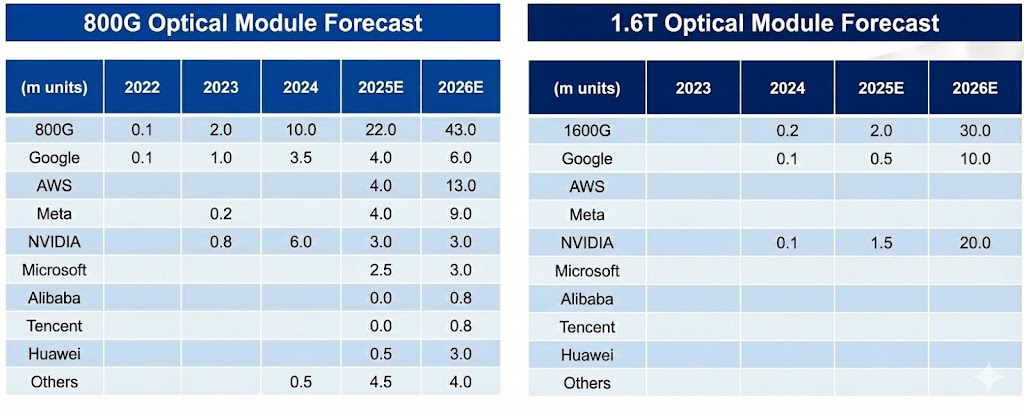

• The projected market size for 1.6T optical modules in 2026 is 30 million units (from the supply chain perspective, this can currently be raised to 36-37 million, but we believe it still needs to align with CoWoS capacity, so we will gradually revise it upward in the future).

• The current focus is on 2027. To our knowledge, Google and NVIDIA continue to increase their figures for 2027, expected to be stronger than 2026 (projected to be more than double). 2026 and 2027 are very strong and concentrated on the highest specification 1.6T.

• Industry-wise, China A-share INNO Light and US-listed Lumentum will both benefit from this trend. We currently see LITE receiving very large 1.6T optical module orders from Google.

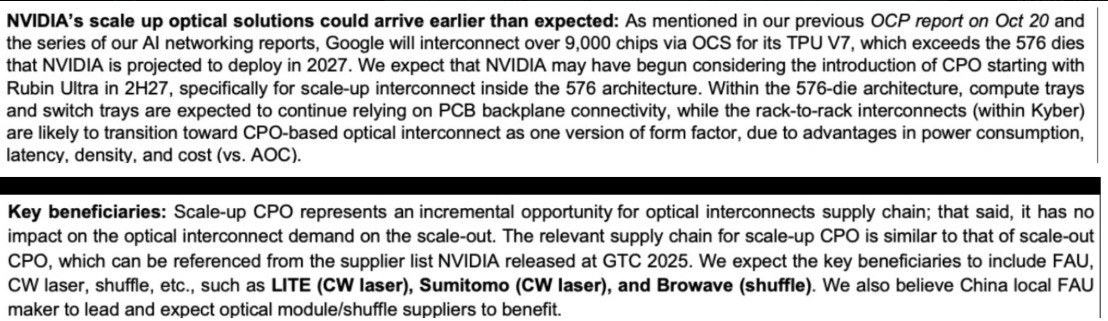

• Regarding CPO (2027 NVL576): The design solution for NVIDIA’s 2027 NVL576 architecture (interconnection of four sub-cabinets) adopts CPO (Co-packaged Optics) interconnection, primarily promoted by Mellanox. Because optical fibers have no distance limitations, the current setup connects 4 sub-cabinets and can simultaneously interconnect 2-4 large Kyber cabinets. (2 cabinets total over 1,000 dies, 4 cabinets total over 2,000 dies). CPO connects the sub-cabinets and does not affect the interconnection of the PCB backplanes within the cabinet.

• 2 Large Kyber Cabinets = 1,152 GPU Dies

• 4 Large Kyber Cabinets = 2,304 GPU Dies

• CPO Supply Chain:

• FAU (Fiber Array Unit): Approximately $350 USD value per Rubin. China A-share Everfu Communication leads significantly in precision and will be the main beneficiary.

• CW Laser: CPO also requires CW light sources, which will exacerbate the shortage of optical chips.

• Shuffle: Fiber optic hub box. Suppliers are Corning + T&S Communications, BroadLink.

Source:Gf Securities

Have a great weekend! We’ll be back in your inbox next week. Thanks for reading!

Insightology Research

What I Read

Aritcle

Podcast

Book

The Big Money: Seven Steps to Picking Great Stocks and Finding Financial Security

Transcript

AVGO Earnings Call Transcript

ORCL Earnings Call Transcript

ADBE Earnings Call Transcript

SNPS Earnings Call Transcript

COST Earnings Call Transcript

LULU Earnings Call Transcript

RH Earnings Call Transcript