Life

We took advantage of the MLK long weekend to take a trip down to Louisiana. It was my first time there! I’d heard you absolutely have to try the Gumbo, Jambalaya, Crawfish Étouffée, and Southern Classic Chicken* to really get a taste of the Deep South.

While I was there, I couldn't help but wonder what it would be like to actually live and work there. I'm super curious about the local lifestyle, so I'll definitely have to explore more next time I visit.

On a different note, I’ve started shifting my focus this year toward real-world AI applications and getting involved in more hands-on projects. I’m even considering jumping into the industry to learn the ropes. Because of this, my future posts will look a little different: aside from my usual tech industry tracking, I’ll be sharing more insights on both the technical and business sides of things.

If any of you are currently building AI apps, hit me up! I’d love to chat and brainstorm together.

Market

TSMC Revises Up CAPEX

The absolute highlight of this week was TSMC's earnings call. Since the news about TSMC buying land in Arizona broke before the call, the market consensus had already anticipated a CAPEX hike. However, what really surprised everyone was that TSMC revised their capital expenditure even higher.

They also announced that CAPEX over the next three years will be “significant.” This is a straightforward, no-brainer win for fab facility engineering and equipment stocks!

Most of the facility engineering companies are based here in Taiwan, while the equipment supply chain is still dominated by US, European, and Japanese firms, with a smaller portion coming from local Taiwanese suppliers.

Highlights:

Q1 2026 Guidance: Gross Margin estimated at 63%-65%; Operating Margin at 54%-56%.

AI Growth: AI CAGR (2024–2029) raised to “mid-to-high 50%” (up from “mid-40s” last quarter).

2026 CAPEX: Estimated at USD 52B–56B. About 70%-80% will go toward advanced process technologies and advanced packaging.

Node Updates: N3 will reach the corporate average gross margin this year, and some capacity is being converted from N5 to N3.

N2 Ramp: N2 is expected to be a larger node at initial ramp compared to N3.

Long-term Outlook: CAPEX for the next three years will be significantly higher than USD 100B.

Legacy: Adjusting 8-inch capacity.

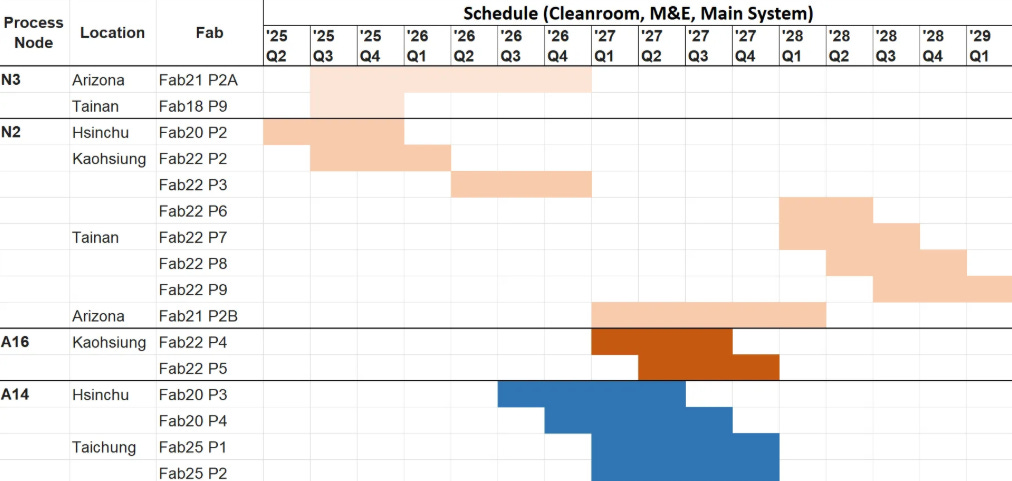

TSMC Advanced Process Roadmap & Fab Construction Update

1. N2 (2nm) Process: Demand Exceeding Expectations

Customer Status: Apple and AMD are scheduled for initial wafer starts by the end of 2025. Qualcomm, Intel, and MediaTek are expected to join between 2026 and 2027.

Capacity Planning:

Hsinchu Fab 20 P1 / Kaohsiung Fab 22 P1: Mass production officially commenced in late 2025.

Hsinchu Fab 20 P2 / Kaohsiung Fab 22 P2: Trial production to begin in Q1 2026.

Kaohsiung Fab 22 P3: Tool move-in accelerated to the end of Q1 2026.

2. A16 & A14 (Angstrom Class) Processes

A16: The first process to introduce Backside Power Delivery Network (BSPDN) technology. Currently, only NVIDIA has been secured as a customer, resulting in a smaller initial production scale. Capacity at Hsinchu Fab 20 P3 and beyond will pivot to the A14 process.

A14: Risk production is expected in 2027, with official mass production in 2028. Anticipated locations are Taichung Fab 25 and Hsinchu Fab 20.

3. U.S. Arizona Construction Progress

Fab 21 P1: Mass production officially started in 2025.

Fab 21 P2A (N3 Process): Completion scheduled for late 2026, with mass production in 2027.

Fab 21 P2B: Construction began in Q2 2025; mass production slated for 2029 at the latest.

Semiconductor Facility Engineering Market Overview

The market is divided into four core sectors: Cleanroom & M&E Integration, Water Recycling, Gas Supply, and Chemical Supply. Driven by TSMC’s accelerated expansion, revenue recognition for these sectors is expected to peak between 2026 and 2028.

I. Cleanroom & M&E Integration

Scope: Plant planning, design, construction, and inspection (HVAC, Power, Central Monitoring, etc.).

Key Players: UIS (United Integrated Services / 漢唐 - Historic major contractor), Yankee Engineering (洋基工程), L&K Engineering (亞翔 - Recent entrant).

Key Player Updates:

L&K Engineering (亞翔): Secured civil and M&E bids for TSMC Fab 22 P7, P8, and P9. Estimated revenue contribution is NT$40–50 billion. Also holds projects for Micron and Vanguard International (VIS) in Singapore, peaking in 2026.

UIS (漢唐): The only contractor capable of establishing a US base; secured exclusive bids for Fab 21 (Arizona). Revenue contribution from US construction is 3–5x higher than in Taiwan, though gross margins are lower.

II. Gas Supply Systems

Classification:

Primary Piping (Main Trunk): High entry barrier; dominated by Taiwan Puritic Corp (和淞).

Secondary Piping (Hook-up): Handled by Rayzher Industrial Co., Ltd.(銳澤), Wholetech System Hitech Limited (漢科), Genii Ideas Co., Ltd. (聚賢), and Chi Yi Hsin Technology Co., Ltd. (騏億鑫).

Key Player Updates:

Taiwan Puritic Corp(和淞): Holds a near-monopoly on primary piping for advanced processes. Backlog approx. NT$33.1 billion as of Q2 2025. Will benefit from tool installation across multiple N2 and N3 fabs in 2026. Cooperation extends to the A14 process (trial line setup in 2026).

Rayzher Industrial Co., Ltd. (銳澤): Focuses on secondary piping. With the main structure of US Fab 21 P2A completed, revenue recognition is expected to peak in H2 2026. Also benefits from tool uninstallation/installation (hook-up demand) during the retrofit of older TSMC fabs (Fab 2/3/5/6) into advanced packaging facilities. Actively promoting its Particle Catcher Device (PCD).

III. Chemical Supply Systems

Scope: Storage, transport, and distribution of chemicals, emphasizing contamination prevention and material compatibility.

Key Players: Marketech (帆宣), Nova (朋億), Cica-Huntek (矽科宏晟).

Key Player Updates:

Marketech (帆宣): Order backlog approx. NT$91 billion as of Q4 2025 (NT$73 billion from semiconductor facilities).

Revenue Peaks: 2026 (Kaohsiung Fab 22 P3, US Fab 21 P2A, Tainan AP8 P2); 2027 (Kaohsiung Fab 22 P4/P5, Taichung Fabs).

Agency Business: Agent for Japanese supplier AIM’s Bonder/De-bonder. Benefits from CoWoS/FOPLP capacity expansion by TSMC, ASE, and Powertech.

IV. Water Recycling Systems

Classification:

Ultra-Pure Water (UPW): Extremely high standards; primarily handled by Organo (Japan)

Wastewater Recycling: Primarily handled by Mega Union (兆聯實業) and Trusval (信紘科).

Key Player Updates:

Mega Union (兆聯實業): Order backlog approx. NT$23.5 billion as of Q3 2025. Followed TSMC to the US; Fab 21 P2A revenue recognition will peak in 2026. US projects contribute higher revenue but yield lower gross margins.

TSMC and Samsung Scaling Down Legacy 6-inch and 8-inch Fabs to Concentrate on Advanced Processes

During the recent earnings call, TSMC mentioned plans to gradually phase out certain 6-inch and 8-inch wafer fabs. The company intends to shift its focus toward higher-margin advanced processes (such as 3nm, 5nm, 7nm, and 2nm) required for AI and High-Performance Computing (HPC) applications.

TSMC

Strategy: Phasing out select 6-inch and 8-inch fabs to pivot resources toward high-margin advanced processes for AI and HPC.

Product Migration: Products originally manufactured in 8-inch fabs (e.g., CIS [CMOS Image Sensors] and PMIC [Power Management ICs]) have already been migrated to 12-inch mature or advanced process nodes.

Samsung Electronics

Closure Plan: Plans to shut down the S7 8-inch line at its Giheung campus in the second half of this year. (The campus houses lines S6, S7, and S8; S6 and S8 will continue operations).

Capacity Impact: following the closure of S7, monthly capacity is expected to drop from roughly 250,000 wafers to below 200,000 wafers (S7 accounts for approx. 50,000 wafers). Existing orders have been transferred to other facilities.

Market Impact: Supply Reduction & Price Hikes

With major players exiting the space, a supply gap is emerging, which is expected to drive prices up.

Capacity Forecast: Global 8-inch wafer capacity is projected to decrease by approximately 2.4% in 2026.

Price Fluctuation: The tightening supply is expected to trigger a price hike for 8-inch foundry services, estimated between 5% and 20%.

Beneficiaries & Competitive Landscape

Tier-2 foundries are welcoming a wave of order transfers. As Samsung and TSMC release market share, orders are flowing to foundries that specialize in mature processes.

Top Winner: DB HiTek (South Korea)、Vanguard International Semiconductor (VIS).

Current Status: Running at full capacity with a significant order backlog; currently unable to accept new orders.

Competitive Advantage: Specializes in analog processes (such as BCD - Bipolar-CMOS-DMOS) and excels in “High-Mix Low-Volume” (HMLV) production (e.g., PMICs and DDIs [Display Driver ICs]).

Opportunity: As TSMC and Samsung continue to reduce capacity, customer orders are highly likely to shift to DB HiTek and Vanguard International Semiconductor (VIS).

What I Read

HBM & DRAM Manufacturing Economics: Process Complexity, Yield Dynamics, and Supply Constraints

TrendForce: Micron收購PSMC銅鑼廠,2027年全球DRAM供給可望上修

SiFive To Adopt NVLInk Fusion For Future Data Center RISC-V CPU Designs

Cerebras Inks Transformative $10 Billion Inference Deal With OpenAI

Cerebras CS-3: the world’s fastest and most scalable AI accelerator - Cerebras

Here are the 55 US AI startups that raised $100M or more in 2025

Samsung to close down one of its 8-inch foundry fabs within the year

翁家翌:OpenAI,GPT,强化学习,Infra,后训练,天授,tuixue,开源,CMU,清华|WhynotTV Podcast #4

The non-technical PM’s guide to building with Cursor | Zevi Arnovitz (Meta)

Great breakdown on TSMC's CAPEX revisions! That Louisiana trip sounds amazing, first time trying proper jambalaya and etouffee must've been wild. The TSMC numbers are staggering tho, especialy that mid-to-high 50% AI CAGR revision.