Weekly Shots of Insight and Market #2

Optical Communication Industry, Yamamoto philosophy, Memory Update

What I Enjoy

First, congratulations to the Dodgers on winning the World Series, and congratulations to Yamamoto Yoshinobu for winning the MVP this time. Because of this game, I went back and watched Yamamoto’s story. He can be described as a late-bloomer type of player. In the past, in high school and in the pros, he was not as formidable as Shohei Ohtani. He did not make it into Koshien in high school, nor was he the ace pitcher, and he only transitioned to pitching in high school.

After joining professional baseball, he was troubled by an elbow injury in his first year. Even after resting for ten days, the tightness in his elbow could not be eliminated. This made him realize that if his physical condition did not improve, he would not be able to consistently perform in professional games.

To break through the predicament, he began seeking new training methods and met trainer Osamu Yata. He thoroughly changed his pitching form and training philosophy (https://www.dailyshincho.jp/article/2025/10300602/?all=1&page=2), and even temporarily “sealed off” his signature slider to reduce the burden on his elbow. After the change, Yamamoto Yoshinobu was completely reborn, winning the Sawamura Award, MVP, and the pitching quadruple crown for three consecutive years during his time with the Orix team, becoming the strongest ace in Japanese baseball.

Quoting Mr. Osamu Yata: A tree has a trunk, branches, and roots. The movements of your hands and feet are like fiddling with the branches. The trunk is certainly important, but it cannot just be stiff. If the trunk is hollow, it will easily break. Therefore, what is truly important is building a sturdy trunk that can withstand strong winds and storms.

At the end of the article, I will also share my reflections on this.

Market: More Focus on the Optical Communication Industry

Optical Communication Industry Tracking: AI Needs Light! Optical Modules Benefit from Strong 1.6T Demand; 2026 is a Year of Sustained Explosion

First, this week I mainly focused on the latest quarterly conference calls of these two companies, Lumentum and Coherent.

Why I am researching them:

If NVIDIA’s GPUs are the brain of AI, then what Lumentum and Coherent provide is the ultra-high-speed nervous system. When studying AI, a major trend is discovered: AI computing has shifted from solo efforts (one GPU calculating slowly) to group operations (thousands of GPUs calculating together). And Lumentum and Coherent are the most crucial arms dealers for this group operation.

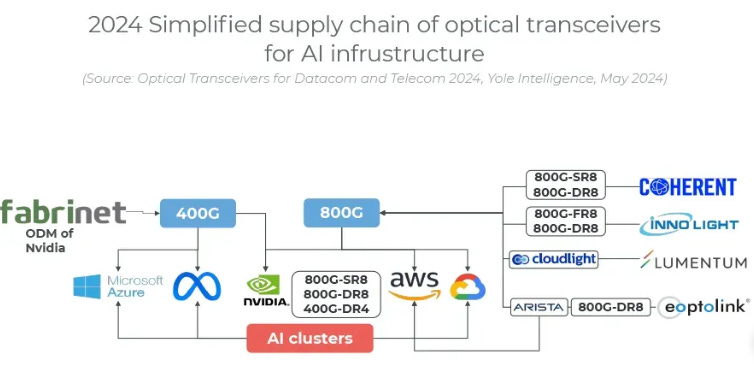

In terms of transmission specifications, the current development is reaching 800G and 1.6T specifications. What does this mean? It means transmission speeds of 800 Gigabits and 1.6 Terabits per second. Furthermore, they focus more on transmission between racks, responsible for long-distance transmission (over 7 meters). In contrast, Credo (also a company with excellent technology), which we often hear about, mainly focuses on connection cables within the rack.

Long-distance transmission must use Coherent/Lumentum’s “optical modules,” which are expensive (lasers are expensive), and consume power (lasers generate heat and require cooling), but they have almost no loss. Therefore, this optical module is what converts the “electrical signal” inside the rack into the “optical signal” between the racks.

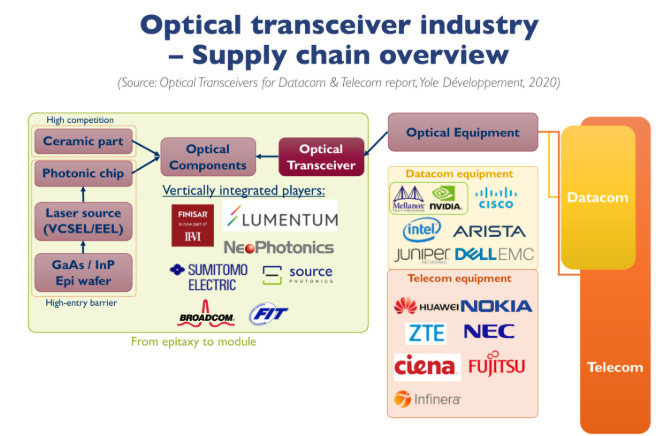

A brief introduction to the businesses of these two companies and their positions in the supply chain:

Lumentum: “Optical communication components + module supplier”. Primarily produces cloud and telecom optical communication components + modules (including data center optical modules after the Cloud Light merger), Optical Circuit Switches (OCS), ROADM, tunable lasers, EML/DFB/VCSEL, etc.. Also has industrial and 3D sensing lasers (Industrial Tech).

Coherent: “Full-line manufacturer from materials to optical modules”. Mainly plays the role of “upstream” and “midstream”. Revenue sources include Networking (data center/telecom optical transceiver modules and components, such as 400G/800G/1.6T, 100/400/800G ZR/ZR+, etc.), Materials (SiC, GaAs/ InP and other compound semiconductors and engineered materials), and Lasers (industrial, display, and scientific lasers).

Source:Yole

LITE not only has outstanding performance, but 1.6T is a huge explosion, starting a furious ramp-up in 2026

Lumentum achieved the highest revenue in the company’s ten-year history this quarter, with total revenue reaching $533.8 million. Revenue growth exceeded 58%. The company estimates that over 60% of total revenue comes from cloud and AI infrastructure. Lumentum expects to reach the quarterly revenue milestone of $600 million two quarters earlier, in the second quarter (Q2) of fiscal year 2026.

The company has changed its financial reporting to a single reporting segment and categorized product line revenue into two types: Components and Systems.

Viewed by business segment:

Components Revenue: $379 million, QoQ +18%, YoY +64%, driven by data center and long-haul applications.

Systems Revenue: $155 million, QoQ -4%, YoY +47%, mainly from cloud transceiver modules.

EML laser shipments hit a new high, predominantly 100G, with 200G starting to scale up, expected to account for 10% by early 2026.

DCI narrow linewidth laser components grew for seven consecutive quarters, YoY +70%.

3D sensing products account for less than 5%, showing seasonal growth.

Major Growth Engines (AI Three Arrows): The company explicitly points out that growth over the next few years will be driven by three core product lines that together form the backbone of AI infrastructure:

Cloud Transceivers: This business segment is expected to accelerate growth over the next 4 to 5 quarters. The company aims to push this market opportunity to a quarterly revenue of $250 million.

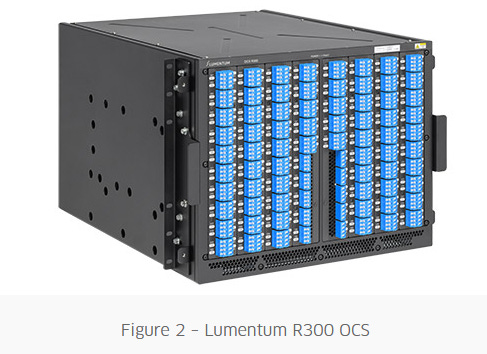

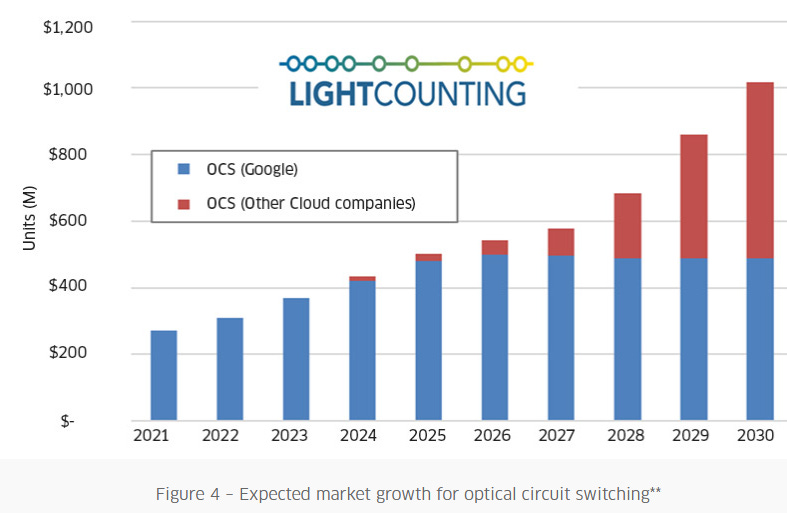

Optical Circuit Switches (OCS): This product is used to reconfigure data center network paths. Lumentum’s confidence in this product has increased significantly, expecting OCS quarterly revenue to reach $100 million by the December quarter of 2026.

Co-Packaged Optics (CPO): Demand for CPO is stronger than the company initially anticipated, with substantial revenue contribution expected to begin in the second half of 2026.

ML Laser Shortage (Indium Phosphide): Market demand for its core Indium Phosphide (InP) laser chip (the critical light source for high-speed fiber networks) far exceeds its supply capacity. This forces the company to make difficult capacity allocation decisions, prioritizing resources for the highest-margin components, such as 200 gig MLs.

Capacity Expansion Strategy: Although demand is strong, the company commits to increasing unit capacity by approximately 40% in the coming quarters by improving yield and output. The focus is mainly on four-inch wafers, rather than large-scale capital expenditure expansion. Also, due to the severe imbalance between EML laser supply and demand, Lumentum is leveraging this advantage to implement targeted price increases to boost gross margin.

1.6T Transceivers have better margins: Management expects gross margin to continue improving in 2026 with the increasing proportion of 200 gig MLs, the launch of 1.6T transceivers, and the maturation of high-margin new product lines like OCS and CPO. Specifically, the profit margin for 1.6T transceivers will be “significantly better than 800G products”.

OCS Mega Storyline: Targeting $100 million/quarter in 2026. The official timeline is clear: several million dollars in 2025/12, tens of millions (M) in 2026/3, $50–60M in 2026/6, $100M in 2026/12, and long-term $250M/quarter. Three customers are running qualifications, and software is still being supplemented.

CW vs EML is not a forced choice; both will rise. Capacity can be interchanged, and no matter how the market moves, everything will sell out. This is called true supply chain flexibility + a seller’s market. Currently, LITE is also the exclusive supplier of Nvidia CW Laser.

CPO Interest Surge: Customer and market interest and participation in CPO have increased significantly. The company ensures its Indium Phosphide capacity can be flexibly switched so that Lumentum can provide services regardless of which laser technology CPO ultimately adopts (ML or CW).

Personal View: Lumentum is essentially saying: demand is too strong, supply is too little, everything is out of stock, everything has long-term contracts, and prices will still rise in 2026. AI is truly exploding the entire optical communication supply chain.

What is impressive is the company’s OCS product, which allows data to be dynamically switched directly in the form of light, without converting to electrical signals. It can support tens of thousands of GPU clusters and save up to 65% of power compared to traditional switching methods.

COHR: 1.6T starting to ramp up next year, Upstream InP is key

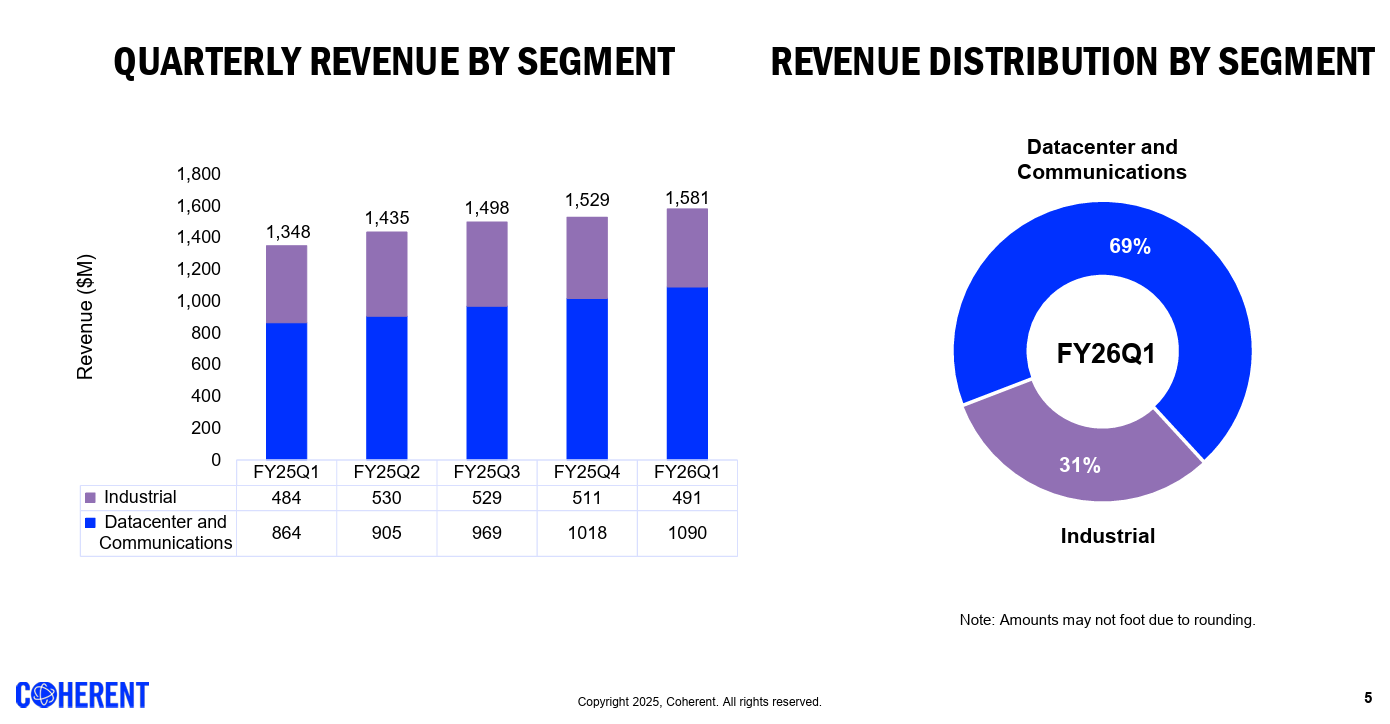

First, a review of the company’s performance:

Q1 2026 revenue was $1.58 billion, QoQ +3%, YoY +17%. Excluding the divested aerospace and defense business, revenue grew QoQ 6%, YoY 19%. Non-GAAP EPS was $1.16, QoQ +16%, YoY +73%.

Q2 2026 Guidance: Revenue estimated at $1.56-$1.7 billion, Non-GAAP gross margin 38-40%, Non-GAAP EPS $1.10-$1.30.

Viewed by business segment:

Datacenter & Communications: Q1 revenue QoQ +7%, YoY +26%; Data center business QoQ +4%, YoY +23%; Q2 guidance QoQ growth of about 10%.

Communications (including DCI and traditional telecom): Q1 revenue QoQ +11%, YoY +55%, continuous growth for five quarters, Q2 expected to continue increasing.

Industrial: Q1 revenue QoQ +2%, YoY +4% (excluding aerospace and defense), Q2 expected to be flat or slightly increased.

Q1 Non-GAAP gross margin 38.7%, QoQ +70bps, YoY +200bps.

Q1 Non-GAAP operating expenses $304 million, accounting for 19.2% of revenue, down from the same period last year.

The key point for Coherent this quarter is: AI data center and communication demand is so strong that the supply chain is still catching up. The overall strategy—from mass production, technology, capacity, and gross margin—is accelerating.

In terms of growth momentum, the Data Center and Communications segments are the largest and fastest-growing areas. Q1 data center revenue YoY +23%, Communications YoY +55%. The company explicitly pointed out that orders for 800 G and 1.6 T transceivers are “record-breaking,” and the adoption of 1.6 T is accelerating.

Capacity and Deployment: With Indium Phosphide (InP) lasers being the capacity bottleneck, the company initiated a 6-inch InP production line, while simultaneously increasing capacity for EML, CW lasers, and photodiodes. The 6-inch InP production line in Sherman, Texas, USA, has started mass production, and the yield is already better than the old 3-inch line. A second 6-inch InP production line in Järfalla, Sweden, has been simultaneously started, and internal capacity is expected to double within the next 12 months. For module assembly, in addition to the existing Ipoh, Malaysia factory, the new Penang factory has started operation, and the existing component factory in Vietnam will also be upgraded to join module production.

Compared to Lumentum, Coherent is actually a consolidation of three giants (II-VI, Finisar, and Coherent itself). For the 6-inch InP technology, the real contributor is Finisar:

Jumping from 3-inch to 6-inch wafers presents an exponential increase in difficulty. It is not as simple as making a pizza bigger.

Material Properties: Indium Phosphide (InP) is a compound semiconductor that is extremely fragile (unlike Silicon, which is sturdy).

Manufacturing Difficulties: The larger the wafer size, the harder it is to maintain “uniformity” and a “low defect rate” during crystal growth.

Finisar’s Big Bet: Years ago, when the rest of the industry was content with 3-inch or 4-inch lines, Finisar invested huge R&D funds and resources to overcome the manufacturing challenges of 6-inch InP.

Through the acquisition of Finisar, the current Coherent inherited two “ace” factories: Järfälla, Sweden, and Sherman, Texas, USA. These two factories were the main bases for Finisar’s past R&D into 6-inch InP.

The company mentioned that many orders are for “more than a year later,” indicating that customers are not just pulling goods in the short term but are planning ahead. High technological barrier and difficulty in switching: InP lasers are capacity-limited items, but the company gains a differentiated advantage through the 6-inch upgrade.

Gross margin improvement is not solely reliant on volume but combines capacity upgrade and price optimization. The company stated that margin improvement comes from pricing optimization + yield improvement + cost reduction.

AXTI: InP Successfully Obtains Export License, Expected to Usher in Tsunami-like Growth

Indium Phosphide (InP) hits a new high: InP revenue reached $13.1 million, the highest level since 2022, primarily attributed to the successful acquisition of export licenses.

Record InP Order Backlog: As of now, the InP order backlog has exceeded $49 million and continues to grow, representing the largest backlog in the company’s history.

Customers realize that the “just in time” model is no longer applicable, and they are willing to give longer lead times for orders so that AXT has time to submit license applications and ship on time.

Capacity Planning:

AXT’s current InP capacity is about $20 million per quarter.

Increasing capacity by 25% only takes about three months, simply by activating more existing furnaces.

Doubling capacity (reaching about $40M/quarter) requires about nine months, with an estimated capital expenditure of $10 million to $15 million, utilizing existing facilities and land.

Future 5-10 fold “tsunami” growth is mainly expected from the large-scale application of Co-Packaged Optics (CPO).

In terms of customer structure, customer concentration and the number of large customers increased this quarter. The top five customers accounted for 45.2%, and two customers exceeded 10% (in 25Q2, the top five customers accounted for 30.9%; one customer exceeded 10%).

Insightology View (AXTI):

The company estimates they hold at least a 40% share of the Indium Phosphide substrate supply in the global market. Sumitomo, the largest supplier, announced two capacity increases in the past three to four months.

In the short term, the entire industry is expanding. We believe we must be more cautious about Chinese suppliers. After all, companies like Tianke Heda, Shanghai Simgui, and Crystal Run Semiconductor are continuously improving process yields. Looking back at SiC’s Wolfspeed, we know that being the leader doesn’t prevent you from being bankrupted by competition. Therefore, continuous attention to the future market is necessary.

Insightology View for Optical Communication Industry

Based on the latest quarterly statements from the entire supply chain, 1.6T will begin to ramp up next year. According to our internal research, two major demand customers come from Nvidia and Google. Nvidia benefits because the yield rate of the GB300 in the supply chain next year is better than expected, and demand from CSP customers is stronger. Google benefits because TPU V7 is expected to start mass production next year, and potential customer Anthropic is expected to purchase TPUs from Google by the end of next year or the year after.

Overall, we remain optimistic about the development of AI optical communication next year.

Memory Industry Follow Up

SanDisk Significantly Upgrades Exabyte Demand Forecast

Significantly upgraded the Exabyte demand forecast, from an expected growth of 20% to 40%-50%. (230 EB in 2024, expected high 300EB in 2026).

It is predicted that calendar year 2026 will be the first time that data center NAND demand surpasses mobile devices, becoming the largest sub-market in the NAND market (structural shift).

The market is expected to be in a state of short supply. Previously, the shortage was mentioned until the end of 2026, but discussions are now actively initiated with SanDisk regarding supply issues for 2027.

Customers are starting to sign long-term contracts with the company, whereas contracts were typically only for one quarter in the past.

The company also provided guidance for overall NAND demand: The company predicts that the current supply capacity of various NAND manufacturers in 2026 (about 17% growth) can only satisfy about 14% of constrained demand growth. However, the actual potential market demand is about 25% growth, leaving a gap of close to half of the potential growth unmet, about 8 percentage points or higher.

Asian Memory Supply Chain: Transcend, Winbond, Nanya Tech, Phison

Transcend (創見) - November 7 Media Briefing

Market Status: Chairman Tsung-Wan Su described this wave of memory shortage driven by AI as the “most severe in 30 years”.

Price Outlook: NAND Flash suppliers failed to deliver in October, which is rare, leading to a 50% surge in contract prices in November.

DRAM Supply/Demand: DDR4 capacity is difficult to increase further, and supply remains tight; DDR5 has a better chance of opening up new capacity.

Q4 Outlook:

Memory prices are expected to continue rising due to sustained supply tightness.

The company will flexibly adjust inventory configuration to ensure stable supply.

Operations will focus on high value-added industrial control and enterprise-level products (DDR4/DDR5).

Winbond (華邦電) - November 5 Investor Conference

Operational Overview: Q3 DRAM segment revenue hit a three-year high, with a gross margin of up to 51%.

Q4 Outlook:

Revenue, shipments, and average selling price (ASP) are expected to grow simultaneously.

Capacity utilization is near full, expected to maintain good profitability.

2026 Outlook: General Manager Pei-Ming Chen expects next year to be “a year of healthy growth”. There are even reports that the GM believes the memory shortage could extend into 2027.

DRAM Supply/Demand (Niche):

DDR4 demand remains strong (as many customer SoCs still do not support DDR5).

After the three major original manufacturers shift to high-end processes, it is difficult for them to return to producing DDR4, causing a “structural shortage,” which benefits Winbond.

Flash Supply/Demand: NOR and SLC NAND inventory has been cleared. Demand is robust, and prices and demand are expected to rise simultaneously.

Future Planning: The board approved capital expenditure of approximately NT$35.5 billion for expanding production capacity at the Kaohsiung plant (DRAM) and the Taichung plant (Flash).

Phison (群聯) - November 7 Investor Conference

Operational Overview: Q3 financial report was outstanding, with quarterly earnings (EPS) exceeding NT$10 (one capital unit).

Long-Term Outlook (NAND): The company is optimistic about the application of AI inference, which will lead to the NAND supply tightness continuing for several years.

Q4 Outlook (Market Expectations):

Analysts estimate that due to the QLC (Quad-Level Cell Flash Memory) shortage, demand will spill over to TLC NAND.

Q4 NAND contract prices are expected to rise by 15% to 20%.

2026 Outlook (Market Expectations): Domestic and foreign institutional investors are optimistic that Phison’s profit might double next year.

Conclusion

Transcend directly pointed out the “most severe shortage in 30 years” and the surge in NAND prices.

Winbond emphasized the niche of DDR4’s “structural shortage” and is optimistic that this boom will continue for several years.

Phison benefits from rising NAND prices and pointed out that AI inference will be the key driver of NAND demand tightness for the next few years.

Insightology View: HDD demand is more concentrated in AI-benefiting data centers, allowing its growth rate to surpass NAND.

To estimate the pure AI contribution, we first need to assume a “non-AI” baseline.

Personal Estimate (Non-AI): Assume traditional/non-AI Server NAND bit demand naturally grows by approximately +20% ~ +25% annually.

Calculation (AI Contribution): * Total growth in 2026 (+45%) minus Non-AI growth (+20~25%).

= AI Inference contributes 20~25 percentage points of growth.

Based on the 2025 Server NAND total volume of approximately 270EB as the base period, this means AI inference will bring an additional 54 ~ 68 EB of NAND bit demand in 2026.

AI inference does not use 100% SSD (NAND). In the process of LLM inference, the storage configuration is likely hybrid.

Key Assumption: In the storage configuration for AI inference, approximately 33% uses SSD, while 67% still uses HDD.

HDD Demand Calculation:

If 54~68 EB of NAND demand accounts for 33%,

Then the additional demand for HDD (accounting for 67%) will be as high as 108 ~ 136 EB.

In summary, AI inference will potentially contribute an additional 162 ~ 204 EB of total storage capacity increment in 2026. This will drive the overall growth of two industries, respectively:

NAND (SSD) Industry:

The AI contribution of 54~68EB demand will boost the NAND overall bit demand growth rate:

From the recent +14~16%

Up to +20% ~ +23.5%.

HDD (Hard Disk Drive) Industry:

The AI contribution of 108~136EB demand will boost the HDD overall bit demand growth rate:

From the recent +18~22%

Up to +24% ~ +29%.

The short-term growth rate of HDD (+24~29%) is expected to be higher than NAND (+20~23.5%). This seems counterintuitive but is actually very reasonable. The answer lies in the “denominator”: Although NAND is critical, its total demand still comes 70% from the short-term slowing consumer market (PC, mobile phones). This severely drags down its overall growth rate.

In contrast, HDD demand is more concentrated in AI-benefiting data centers, allowing its overall growth rate to surpass NAND.

This calculation is consistent with the recent optimistic views of Seagate and Western Digital. We have every reason to believe that these two companies will again raise their demand outlook for 2026 in the coming quarters.

Epilogue

Finally, returning to the beginning of the article, what intrigued me the most was the method used by the physical therapist. After assessment, Mr. Osamu Yata believed that Yamamoto’s elbow pain was not an issue with the elbow itself, but stemmed from his “incorrect use of the body” and “inconsistent pitching mechanics”. His pitching style at the time (perhaps including traditional weight training methods) placed excessive stress on his elbow.

Harmony is More Effective Than Brute Force

After some research, Mr. Osamu Yata developed a system whose goal is “not to train muscles, but to awaken the body’s dormant senses and range of motion”. This shifted the training focus from strengthening (muscular power) to sensation and connectivity (coordination). This is called the “BC Exercise” (BC エクササイズ), a very unique and “anti-traditional” training system. The meaning of BC includes “Body Coordinate” or “Bio” (Life) and “Cell”, meaning to fundamentally improve the body’s operation.

He believes that excessive muscle strengthening restricts the body’s flexibility and coordination, becoming an obstacle to peak performance. Therefore, his training menu is highly original, such as using light javelins to correct body coordination during pitching, or using inverted walking and bridge poses to strengthen full-body coordination. Behind this lies the profound concept of Datsuryoku (脫力)—which is not simply relaxation, but “not using superfluous power,” allowing necessary muscles to function at the necessary moment. This pursuit of efficient, harmonious power output is the foundation for building Yamamoto’s “unbreakable body” (壊れない身体)—a body possessing both flexibility and explosiveness. Its durability comes from the flexible connection of joints and fascia, rather than stiff muscles.

“Better Than Yesterday” — Mental Strength Proves the Limits of the Flesh

This unique physical foundation created the conditions for seemingly impossible endurance performance. However, Yata believes the true catalyst did not originate from the physical body, but from the mind. His perfect relief performance on “zero days rest” during the World Series is the best proof.

In fact, at five o’clock that morning, Yata received a message from Yamamoto. This detail made Yata realize that Yamamoto was under extreme tension and highly focused. When Yamamoto Yoshinobu’s intense will to “want to win” reached its peak, the body operated smoothly in response, as if mental strength eliminated physical fatigue and limitations. Yata’s interpretation perfectly embodies his philosophy: “It is because of that Qi—that spirit and will—that this was achieved”. This is not merely a display of willpower, but the ultimate proof that mental intensity directly acts upon the physical body, enabling it to surpass physiological limits.

“The Answer Is Within You” — Guiding “Awareness” Instead of Directly “Teaching”

The core of Coach Yata’s guiding philosophy is “not teaching from the outside, but sensing from within”. He never directly gives players the “correct answer”. This was evident from their first meeting: Facing the then 18-year-old Yamamoto Yoshinobu, Yata did not make any formal corrections. Instead, he guided him to “verbalize the current dynamics of his body,” making him describe the pressure on his soles and the shift of his center of gravity.

Through questioning and prompting, he guides the player to turn their attention to internal body sensations. Among these, “breathing” plays a conductor-like role, connecting the rhythm of the mind and body. Coach Yata uses a vivid analogy to explain this concept: “People always focus on the hands and feet, but those are just the branches and leaves. The trunk is what’s important. If the trunk is hollow, the branches will break”. This teaching method cultivated Yamamoto’s strong “subjectivity”. He stopped passively receiving training and proactively became the “internal supervisor” of his own body. This also explains why Yamamoto always refers to his training content as “trade secrets”. This is not only for confidentiality but also to “allow the acquired sensation to continue maturing within himself,” deepening his self-sovereignty over his body.

“Posture is the Root, Form is the Result” — Starting with “Standing Correctly”

In Yata’s theory, the starting point of everything is extremely simple: “Standing correctly is the beginning of everything”. He believes that if the body’s alignment (head, ribcage, pelvis, feet) is not in a straight line, the force transmission chain will deviate. To achieve this, he had Yamamoto spend a great deal of time on the most basic standing posture and breathing sensation, emphasizing that “if the root is stable, the branches and leaves will naturally be tidy”.

This highlights the fundamental difference between Yata’s theory and traditional posture correction. Traditional methods correct “form” externally, while Yata adjusts the “root” internally. He firmly believes that “Form is the result of sensation, not the cause” (形は感覚の結果であって原因ではない). Yamamoto Yoshinobu’s stable and elegant pitching form was not a deliberate imitation of some “ideal form”, but the “natural result” when his inner sensation, body balance, and breathing rhythm were all adjusted to their optimal state.

Conclusion: Returning to the Body’s Voice

The mentorship between Osamu Yata and Yamamoto Yoshinobu not only created miracles on the field but also offered a profound reflection for modern sports science. The core spirit of Yata’s theory is that true strength does not come from fighting the body or training muscles, but from engaging in a deep dialogue with the body and fully trusting internal sensations.

By “awakening” the body instead of merely “training” it, and “guiding” awareness instead of “commanding” form, and grounding everything in a stable “posture”, Yata ultimately empowered Yamamoto to become his own “inner coach”—a true master of his physical and mental state. Yamamoto Yoshinobu is not just a technically superb pitcher; he is also a “philosopher of the body”.

This made me rethink my current working philosophy. In the process of investing, researching, and living, it is more important to turn back and observe my inner self, body, and emotions. Before making every decision, I need to return to the core: only invest in businesses you truly understand. I believe Warren Buffett’s investment philosophy is very similar to Mr. Osamu Yata’s philosophy.

And to understand:

A company’s “moat“ is the “power chain” of its business model.

A mediocre company: might have “good products” (strong arms), but a messy “supply chain” (tight thoracic spine), and poor “cash flow” (weak core). Its strength cannot be transmitted, and it is prone to “injury” at any time.

The most important primary goal is “injury prevention”.

This is synonymous with Buffett’s “First Rule: Never lose money,” which is the equivalent of the BC philosophy’s “Never get injured”.

Finding the “margin of safety” of a business is the cornerstone of investment.

And Awareness (Anti-Traditional): Acting when the “market is imbalanced”.

Similar to Buffett’s Philosophy: “Be fearful when others are greedy, and greedy when others are fearful”.

Buffett is the strongest BC Philosophy investor. Throughout his life, he has “rejected brute force” (not chasing hot spots). He only operates on his “central axis,” waiting for businesses with a “perfect power chain” (a moat). He only takes “smooth action” when provided with “absolute safety” (margin of safety). He is not “investing”; he is performing “the BC exercise of investing“.

—

In an era pursuing efficiency and data, and full of rapidly updating AI information and technology, we might need to listen more to the truest voice of our own body. The real answer has always been within us. Gradually building a sturdy trunk makes us more capable of facing the fast market winds and turmoil.-Insightology Research

What I Read

Transcript

COHR Earnings Call Transcript

LITE Earnings Call Transcript

AXTI Earnings Call Transcript

SanDisk Earnings Call Transcript

Asia Supply Chains Earnings Call Transcript

Youtube

Book & Aritcle

Rewire: Break the Cycle: Alter Your Thoughts and Create Lasting Change by Nicole Vignola (Author)

https://news.yahoo.co.jp/articles/52bc23f9c45e1e309cd46109adacb535af6a1ae1